Home » Economic update for pharmacy sector

Budget 2025 was presented on 1 October. As expected, it was a very substantial package that will inject a lot of money into the economy over the coming year. The financial position for Government in framing the budget was exceptionally strong. A budget surplus of €25.4 billion was projected for 2024 ahead of the budget day changes to taxation and expenditure. At its disposal the Government had €14.1 billion from the Apple Tax ruling; €3.1 billion from the sale of AIB shares; and a €1.5 billion surplus in the National Training Fund.

In framing Budget 2025, a number of issues stood out:

The core package of measures in the budget totalled €8.3 billion, comprising €1.4 billion in taxation measures and core expenditure increases of just under €6.9 billion. A cost-of-living package of €2.2 billion is in addition to this, giving a total budget package of €10.5 billion. Much of the €2.2 billion cost-of-living package will be paid out in various social welfare schemes and energy credits before the end of 2024.

The Government has laid out a longer-term strategy for investment expenditure. €3 billion is being made available for infrastructure spending in 2025, in water infrastructure (€1 billion), housing (€1.25 billion), and electricity grid infrastructure (€750 million). In addition, the Government has committed to using some of the Apple Tax and AIB share sale proceeds to invest in infrastructure over the coming year. It is imperative for the future wellbeing of the economy that there is considerable efficient and effective investment in energy, water, climate change, infrastructure, and public services such as health and education. While Budget 2025 paid lip service to these objectives, it remains to be seen what is delivered over the coming years.

In September just gone, €4.3 billion was transferred into the Future Ireland Fund and €2 billion into the Infrastructure, Climate and Nature Fund. A further €4.1 billion will be transferred into the Future Ireland Fund next year and almost €2 billion to the Infrastructure, Climate and Nature Fund. By the end of 2025, more than €16 billion will have been transferred into both funds. This is a sensible longer-term strategy and is a first step in building up resources to tackle an ageing and growing population.

Budget 2025 is a very stimulatory package and will provide strong support to the overall economy in 2025. The Irish economy should continue to perform reasonably strongly over the coming year.

“It is imperative for the future wellbeing of the economy that there is considerable efficient and effective investment in energy, water, climate change, infrastructure, and public services such as health and education.”

The global interest rate cycle has turned in recent months. The Federal Reserve cut rates by 0.5 per cent at the 17 September FOMC meeting; the Bank of England cut its base rate by 0.25 per cent to 5 per cent at the August meeting; and the ECB cut its key rate by 0.25 per cent at the June meeting and again by 0.25 per cent at the September meeting.

Overall, the interest rate outlook looks positive over the coming months against a background of relatively subdued growth and easing inflationary pressures. Service sector inflation and tight labour markets will probably engender a continued cautious approach, but the trend is going to continue in a downward direction. For the ECB, rates look set to fall by at least 2 per cent in this cycle, meaning there is at least another 1.5 per cent of easing to come over the coming year. One can never be precise, but the magnitude of easing should be substantial as the Euro Zone economy is weak, particularly Germany, and the Euro Zone inflation rate has fallen below the 2 per cent target to 1.8 per cent.

Consumer spending behaviour is quite cautious as the elevated level of consumer prices continues to engender caution. Retail spending on goods has been weak this year.

In the year to August, the volume of retail sales was 2.5 per cent lower than August 2023 and when cars are excluded, the volume of sales was 1.7 per cent lower than a year ago. In the first eight months of the year the volume of retail sales was 0.5 per cent higher than the equivalent period in 2023 and when car sales are excluded, the volume of retail sales was 0.3 per cent lower than in 2023. The cost-of-living escalation is dampening consumer expenditure.

In the first eight months of the year, the volume of retail sales of pharmaceutical, medical and cosmetic articles was 1.3 per cent lower than the same period in 2023.

Source: CSO

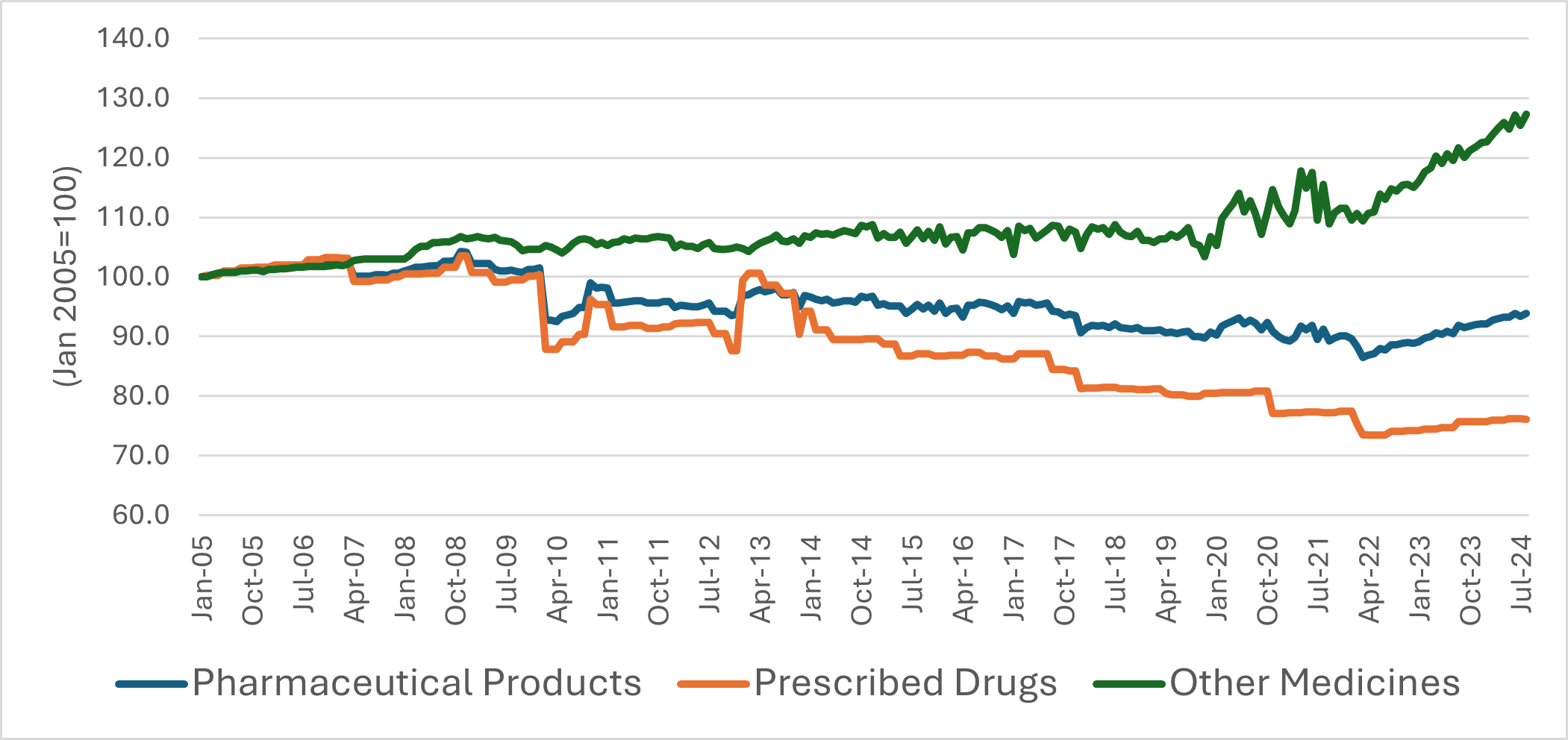

In the year to August, the headline CPI rate fell to 1.7 per cent. Overall pharmacy product prices increased by 2.2 per cent, with the price of prescribed drugs up by 0.5 per cent and the price of other medicines up by 4.6 per cent.

Budget 2025 did little to help the business costs faced by the pharmacy sector.

Jim Power hosts a popular podcast called ‘The Other Hand’.

Source: CSO

In the year to August, the headline CPI rate fell to 1.7 per cent. Overall pharmacy product prices increased by 2.2 per cent, with the price of prescribed drugs up by 0.5 per cent and the price of other medicines up by 4.6 per cent.

Budget 2025 did little to help the business costs faced by the pharmacy sector.

Jim Power hosts a popular podcast called ‘The Other Hand’.

Jim Power

Highlighted Articles