Home » Economic update for the pharmacy sector

At the end of 2022, official and private forecasts for the global economy in 2023 were quite pessimistic. The pessimism stemmed from the ongoing war in Ukraine; the persistence of inflation; pressure on household disposable incomes due to the escalation in the cost of living; pressure on business costs, primarily from energy, but also from the tight labour markets in many countries; and of course, rising interest rates.

In the first quarter of 2023, sentiment has become somewhat more positive. Many global economic indicators are proving modestly positive — labour markets are still strong; headline inflation is easing, primarily due to lower energy costs; and consumer and business confidence surveys (such as the Purchasing Managers Indices) are more positive. The decline in energy costs and the lifting of COVID-related restrictions in China are the primary reasons for the improvement in sentiment. However, it would be dangerous to become complacent about the economic and business outlook — the pressures are still very real, and there are still significant risks and uncertainties.

Inflation is still at very elevated levels; interest rates virtually everywhere are going to rise further; central banks are withdrawing liquidity through Quantitative Tightening (QT), which is the reversal of Quantitative Easing (QE); the Russian invasion of Ukraine has just passed its first anniversary, with no end in sight; and the manner in which China is dealing with Russia is a matter of deep global economic and political concern.

From the perspective of central bankers, there is still deep cause for concern. Although easing due to energy costs, inflation is still too high and the pressure on service sector prices, largely due to wage pressures in still-tight labour markets is a problem, as is the stronger than expected pace of economic activity. It seems clear that most central banks will tighten further. The ECB will continue to tighten rates, with the possibility of another 1.5 per cent from current levels (3 per cent as at 9 March), looking like a realistic risk at the moment.

The CSO has just published the first estimate for economic growth in 2022. It may be historical at this stage, but it does tell us a lot about what 2023 could look like. Gross Domestic Product (GDP) expanded by 12 per cent in real terms in 2022. Output from the multi-national dominated sectors expanded by 19.4 per cent, and output from all other sectors increased by 7.2 per cent. The multi-national component accounted for 55.7 per cent of total value added in the economy last year. The significance of FDI for the Irish economy cannot be underestimated.

Modified Domestic Demand — which is basically a broad measure of underlying domestic activity that covers personal, government and business investment spending, and as such is a better gauge of what is really happening on the ground in the economy, expanded by a very healthy 8.2 per cent. Consumer spending on goods and services expanded by 6.6 per cent, and exports of goods and services expanded by 15 per cent. This growth is more real than GDP in an Irish context and is indicative of a healthy economy in 2022.

In summary, 2022 was a very strong year for the Irish economy, which should come as no surprise given what we have seen in areas such as employment, unemployment, tax revenues and exports. However, activity did soften towards the end of the year, which should also come as no real surprise, given the headwinds from elevated inflation, higher business costs and the significant increases coming through on the interest rate front.

The item that has attracted most attention is the fact that modified domestic demand contracted in the final quarter for the second successive quarter, meaning that the domestic side of the economy went into technical recession in the final quarter. This is due to a contraction in business investment, and output from construction and agriculture.

As we move towards the end of the first quarter of 2023, the momentum is still solid. Employment ended 2022 at a record level of 2.574 million and the unemployment rate fell to 4.3 per cent of the labour force in February, which is virtually full employment. For many businesses, staff shortages still represent a significant challenge in an economy where the vast bulk of those who want to work, can find employment. Recruitment, retention and labour costs pose a significant business challenge.

Tax revenues remain very strong so far in 2023. An Exchequer deficit of €2.5 billion was recorded in the first two months of 2023, compared to a surplus of €0.9 billion in the first two months of 2022. The turn-around of €3.5 billion is due to the Government transferring €4 billion into the National Reserve Fund (Rainy Day Fund) in February, following a transfer of €2 billion last year. This is positive.

The three main categories of taxation continue to demonstrate a sustained level of robust economic activity. Income Tax is up by 7.4 per cent, due to the continued strength of the labour market; VAT is up by 20.6 per cent, with some of this increase due to technical factors, but the underlying level of consumer spending is still reasonably strong; and Corporation Tax is still holding up well, although little is paid in the early part of the year.

| TAX CATEGORY | €m | YEAR-ON-YEAR CHANGE (%) | YEAR-ON-YEAR CHANGE (€m) |

| Income Tax | 5,059 | +7.4% | +348 |

| VAT | 4,063 | +20.6% | +694 |

| Corporation Tax | 646 | +114.8% | +345 |

| Excise | 807 | +2.5% | +20 |

| Stamps | 205 | -19.7% | -50 |

| Capital Gains Tax | 252 | +0.1% | +0 |

| Capital Acquisitions Tax | 38 | -5.7% | -2 |

| Customs | 80 | -29.0% | -32 |

| Motor Tax | 165 | +1.1% | +2 |

| Unallocated Tax Deposits | 69 | ||

| Total | 11,383 | +12.6% | +1,269 |

Source: Department of Finance Fiscal Monitor, 3 March 2023

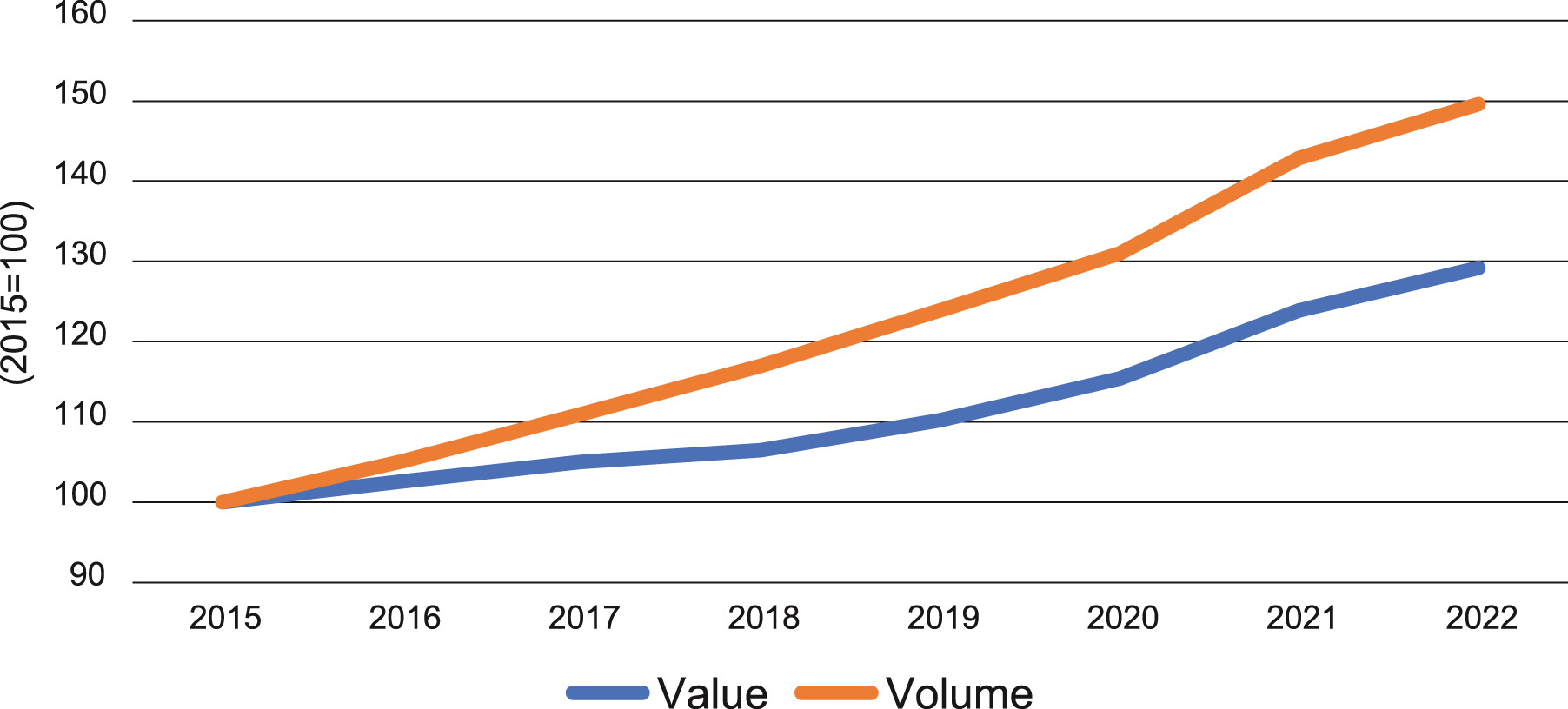

Figure 1: Retail sales of pharmaceutical, medical and cosmetic articlesAll in all, the Irish economy is still showing solid momentum, helped by the strong Government response to the cost-of-living pressures as demonstrated in the Budget 2023 fiscal package in September 2022, and the recent €1.2 billion cost-of-living package. Modified domestic demand is projected to increase by around 3 per cent this year, which although lower than the rate of growth recorded last year (which was exaggerated by the fact that the economy was subjected to significant COVID-19 restrictions in the early part of 2021), would still represent a steady growth performance. At the end of 2022, Irish households had record levels of deposits of €148.6 billion.

In 2022, the value of overall retail sales expanded by 7.6 per cent (reflecting high growth in consumer prices) and the volume of sales declined by 0.6 per cent. The value of sales of pharmaceutical, medical, and cosmetic articles increased by 4.3 per cent, but the volume of sales increased by a higher 4.7 per cent. This is at variance with the rest of the retail sector and reflects the fact that price compression is still a feature of the pharmacy sector.

Source: CSO

In the year to January 2023, the value of overall retail sales increased by 10.5 per cent on an annual basis and the volume of sales increased by 3 per cent. Within the pharmacy sector, the value of sales of pharmaceutical, medical, and cosmetic articles increased by 0.5 per cent in January and by 7.4 per cent on an annual basis; and the volume of sales declined by 2.8 per cent during the month and increased by 4.5 per cent on an annual basis.

Inflation was the dominant theme in Ireland and elsewhere during 2022. It peaked at 9.2 per cent in October and eased back to 7.8 per cent in January this year. In the pharmacy sector, the average price of pharmacy products declined by 0.4 per cent in the year to January 2022, and the consumer price of prescribed medicines declined by 4.3 per cent. The price of other medicines increased by 6 per cent.

“For many businesses, staff shortages still represent a significant challenge in an economy where the vast bulk of those who want to work, can find employment. Recruitment, retention and labour costs pose a significant business challenge.

Source: CSO

Jim Power

Economist

Highlighted Articles