Home » Public attitudes towards pharmacy: 2024 survey

Every year, the IPU engages research and insight firm Ipsos B&A to carry out a comprehensive survey of the public to ascertain their attitudes towards pharmacists and pharmacies, and their usage of the services offered in pharmacies. In this article, Ipsos B&A Director Larry Ryan provides an overview of findings from the 2024 Report.

The IPU has been running an annual index of consumer attitudes to, and usage of, pharmacies since 2006, highlighting changes in the public appreciation of, and reliance upon the sector. Ipsos B&A, formerly known as Behaviour & Attitudes, has run the study since its inception, drawing insights from an invaluable longitudinal perspective of shifts and changes that have occurred over time. The 2024 version of the survey presents a very positive view of the sector and its use and importance to shoppers, albeit with some notable causes for concern apparent too.

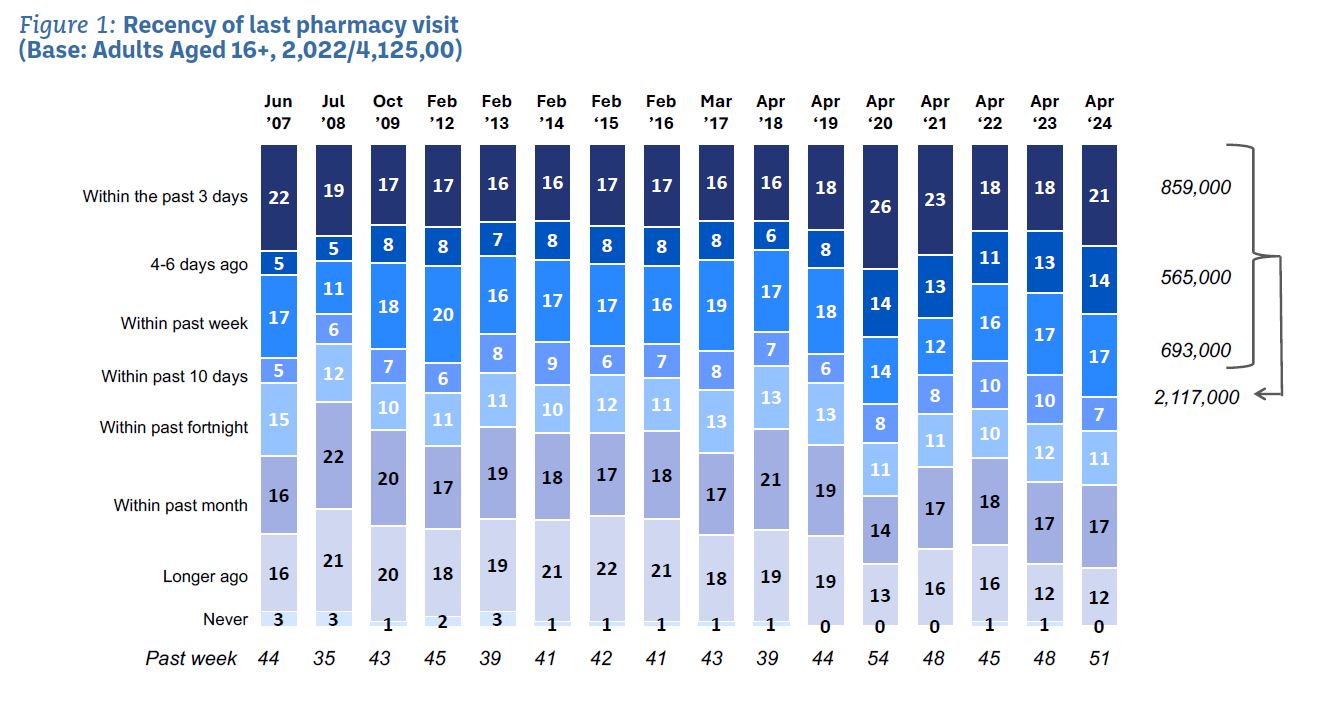

Pharmacy underwent a spectacular period of growth in consumer usage at the time of the COVID-19 pandemic. This wasn’t surprising, as patients were largely unable to visit the GP and the pharmacy was effectively the only place to go with a medical problem or issue. Others might tend to forget how vital pharmacies became in this period, but the numbers opting to visit grew phenomenally. As expected, that level of peak usage has now receded, but rather than falling back towards its historic or longer-term average, has regrown again in 2024, seemingly as customers become more familiar with, and dependent upon, the expanded range of services provided by pharmacy. 51 per cent now visit the pharmacy weekly, down from the pandemic high of 54 per cent, but well in excess of a pre-pandemic weekly average that lay in the mid-forties.

Figure 1: Recency of last pharmacy visit

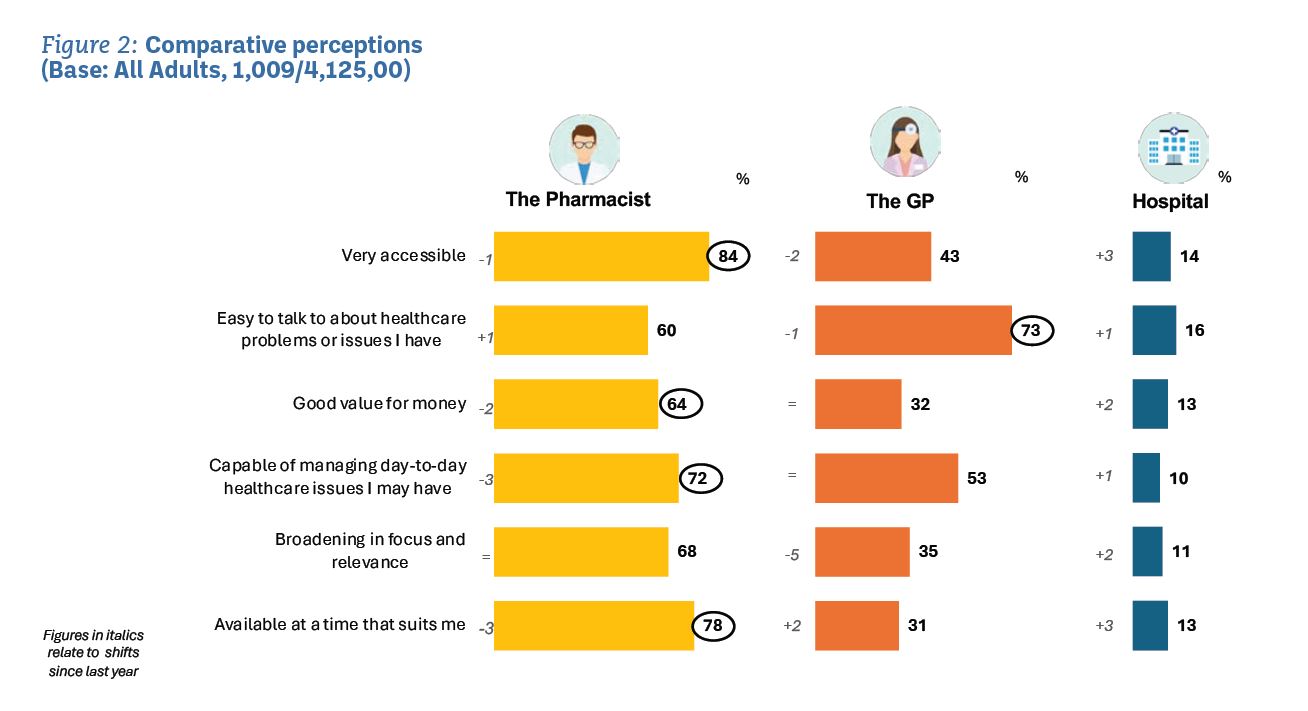

In effect, almost 2.115 million of us visit a pharmacy on a weekly basis, many multiples of the number visiting the GP (about 430,000 per week.) Indeed, we now see that the pharmacist also rates as much more accessible and available to customers than their GP does, performing very strongly against them across a range of comparative assessment measures.

The public evidently appreciates the expanding role and relevance of the sector, but a concern now must be that pharmacies deploy staff and give over the time to handle an increased workload, so that patient/customer satisfaction doesn’t start to recede as a result of customer growth or overcrowding.

We also note that perceptions of the quality and professionalism of advice received from the pharmacist is particularly highly regarded. Indeed, under most, if not all key assessment criteria, the scores that have been achieved by an individual’s regular pharmacy remain notably strong. There are very few areas for caution, although some flags are being flown in the context of perceived value, with some shoppers bringing this aspect into question. Notably, this is at a time when many are struggling with rising prices and issues around affordability and cost of living. In reality, the central issue may be that people’s money is not going as far as it once was and accusations of poorer value at the pharmacy may stem from having less money, as opposed to the pharmacy necessarily getting dearer. Nonetheless, we are all aware that the costs of many medications continue to rise, and this may equally be at the root of these value issues.

Areas for concern, despite the generally strong scores, would be that pharmacies could improve their navigability and signposting of service availability; this is undoubtedly an area which would pay dividends, given the notable enthusiasm for pharmacies broadening the array of services that they provide.

Figure 2: Comparative perceptions

A particularly encouraging facet of the 2024 survey is a returning growth in loyalty to individual pharmacies, an aspect that had gone into notable decline through the pandemic. In effect, at the time of lockdown, many were forced to alter their shopping routines, reverting to use a pharmacy which might be nearby, but not necessarily the one that they would normally have chosen to visit.

However, in the wake of the pandemic, we see a tangible growth in loyalty to individual pharmacies, recovering the longer-term trend that had been in evidence before the onset of the restrictions. It is undoubtedly encouraging to see this growth in loyalty, given that loyal users tend to be much happier and more positive assessors of their regular pharmacy than those who are not loyal to an individual store. It may also stem from a growing appreciation of broadening service at the pharmacy and a decision to frequent a particular pharmacy as a result of their service and care ‘proposition’, or commitment.

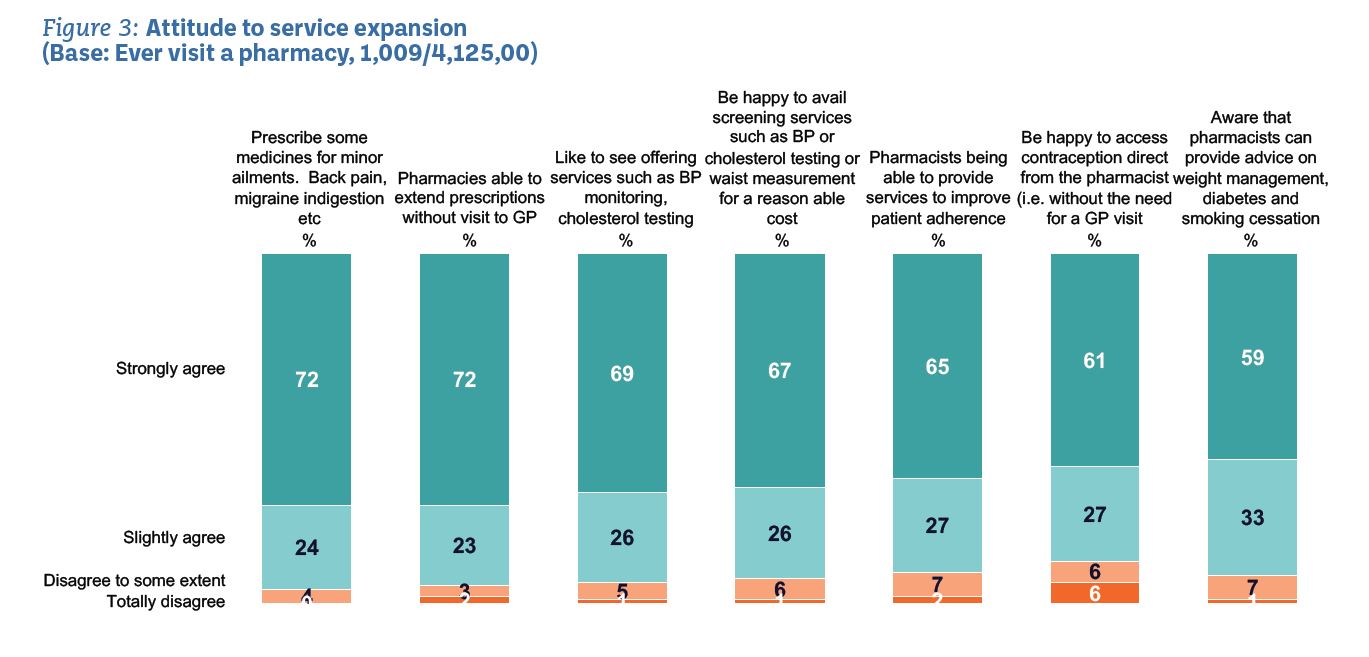

We also note the continuation of a trend seen consistently over recent years of growing consumer support for the broadening of the array of services provided by the pharmacy. Customers are very keen to see the pharmacist broaden into a wider range of different services and treatments, in effect enabling them to expand the use that they make of the pharmacy. In this context, it is not surprising that as many as 86 per cent are now happy to have their vaccinations at the pharmacy.

An important watchout, however, is that as the array of services that a pharmacist can provide expands, there is unquestionably a need to provide clear pointers and signposts as to their availability. This is an area that has been under retreat for some time, with the consumer strongly signalling that they would like to see better highlighting in-store of the widening array of options that are available to them.

Figure 3: Attitude to service expansion

Figure 3: Attitude to service expansion

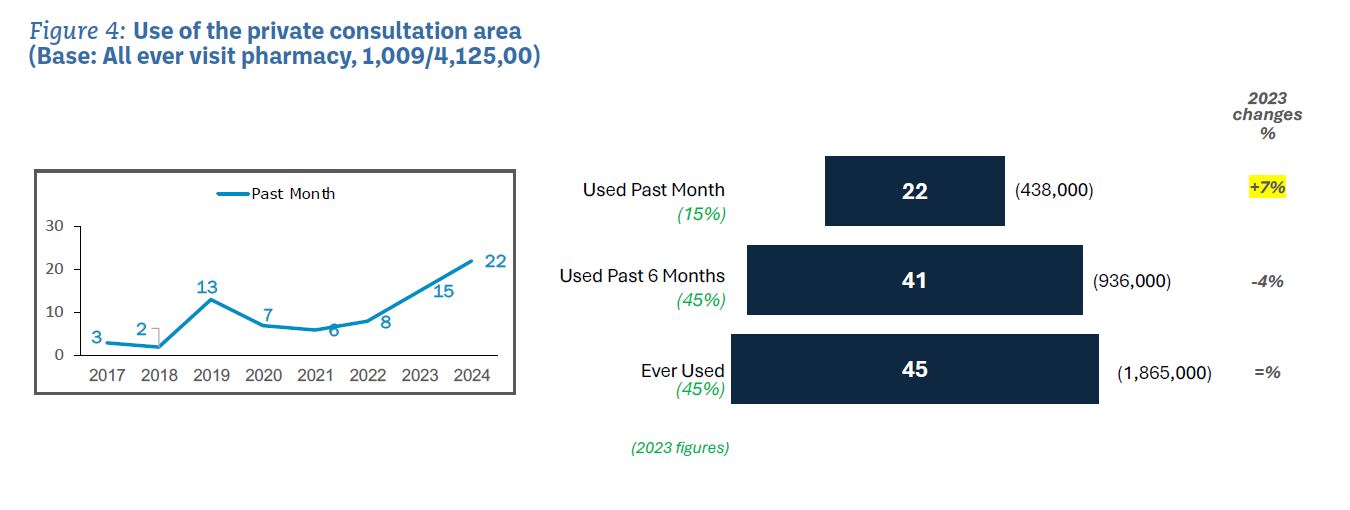

We noted consistently over recent years that although there was widespread enthusiasm to visit and use the consultation area in the pharmacy, the numbers ultimately proving to do so were modest. Nonetheless, in 2024 we see a fundamental transformation in this regard, with a growth by half (from 15 per cent to 22 per cent), in the proportion of weekly/monthly visitors opting to talk to the pharmacist in this space. Now, as many as 22 per cent (or 438,000 in the past month), opt to consult the pharmacist on this basis, a mark of considerable progress, but with still much scope for growth and improvement.

Figure 4: Use of the private consultation area

The principal areas emerging in 2024 as needing additional attention are:

Ultimately, the perspective of pharmacy emerging from the 2024 IPU Index is very encouraging and indicative of a sector that has undertaken significant steps to boost its usefulness and utility to its customer base. There are some shifts required, but the overriding impression is of a sector doing most things right.

The 2024 IPU Pharmacy Index is based on a nationally representative survey of 2,000 adults undertaken by Ipsos B&A. Half of the sample is interviewed face-to-face and the balance online. Behaviour & Attitudes became part of the global research company Ipsos in November 2023 with Larry Ryan remaining as a Director of Ipsos B&A. The full report on the 2024 Index is available to IPU members at ipu.ie > News and Publications > Submissions and Reports.

Larry Ryan

Director, Ipsos B&A

Highlighted Articles