Home » PCRS Annual Report 2024

The Public Service Pay and Pensions Act 2017 (Payments to Community Pharmacy Contractors) Regulations 2019 formalised the remuneration framework for community pharmacy contractors. This article will cover a retrospective analysis of this period since 2019 and highlight key policy developments, particularly changes in State-funded schemes, that have significantly influenced pharmacy reimbursement patterns. These insights will be critical in informing the next rounds of negotiations with the Department of Health, scheduled for June 2026 and 2029.

Recent years have seen major policy changes. Since 2019, the Drugs Payment Scheme (DPS) threshold fell from €134 to €80, bringing more patients under State coverage and reducing their out-of-pocket costs. PCRS data shows that the threshold reduction led to a significant increase in DPS claims, increasing from 7.9 million claimable items in 2019 to 18.8 million in 2024. The introduction of the Free Contraception Scheme has further expanded the scope of pharmacy services. While these changes have increased Community Drug Scheme (CDS) dispensing activity for pharmacies, they have also shifted more activity from private to State-funded dispensing — where reimbursement rates are often lower and administrative burdens higher. Private dispensing levels have stagnated, while State-funded dispensing per pharmacy has grown nearly 31 per cent by volume since 2019.

Future policy decisions must carefully balance expanded patient access with maintaining a viable and resilient community pharmacy network.

The percentage of the population holding GMS eligibility decreased slightly, and the Long-Term Illness (LTI) Scheme saw only a modest rise, from 3.78 per cent to 4.14 per cent (see Table 1). Meanwhile, participation in the DPS doubled, from 5.56 per cent of the population in 2019 to 11.23 per cent in 2024, which is consistent with the policy changes outlined above.

Table 1: Number of eligible persons

| Year | GMS eligibility | DPS eligibility | LTI eligibility | |||

| Number of persons | % of population | Number of persons* | % of population | Number of persons* | % of population | |

| 2019 | 1,544,374 | 31.38% | 273,594 | 5.56% | 185,903 | 3.78% |

| 2020 | 1,584,790 | 31.84% | 280,703 | 5.64% | 190,829 | 3.83% |

| 2021 | 1,545,222 | 30.83% | 308,665 | 6.16% | 195,064 | 3.89% |

| 2022 | 1,568,379 | 30.46% | 445,725 | 8.66% | 202,558 | 3.93% |

| 2023 | 1,611,187 | 30.51% | 526,619 | 9.97% | 212,973 | 4.03% |

| 2024 | 1,561,730 | 29.03% | 603,959 | 11.23% | 223,000 | 4.14% |

Source: Annual PCRS Reports.

*The DPS and LTI figures shown refer to the number of eligible patients for whom claims were submitted to the PCRS by pharmacies.

Between 2019 and 2024, Ireland’s population increased by nearly 460,000 — a 9.3 per cent jump (see Table 2). Yet, the number of HSE pharmacy contractors barely budged, rising just 1.5 per cent (from 1,884 to 1,912). This means each pharmacy now serves more people than ever before: the average climbed from 2,612 patients per pharmacy in 2019 to 2,814 in 2024, driving increased workload in pharmacies.

Table 2: Number of HSE pharmacy contractors and patients per pharmacy

| Year | Number of HSE pharmacy contractors | Year on year change | % change on the previous year | CSO National Population | Patients per Pharmacy | % change since 2019 | |

| 2019 | 1,884 | 14 | 0.75% | 4,921,500 | 2612 | ||

| 2020 | 1,900 | 16 | 0.85% | 4,977,400 |

|

0.3% | |

| 2021 | 1,915 | 15 | 0.79% | 5,011,500 |

|

0.2% | |

| 2022 | 1,915 | 0 | 0 | 5,149,139 |

|

2.9% | |

| 2023 | 1,911 | -4 | -0.21% | 5,281,600 |

|

5.8% | |

| 2024 | 1,912 | +1 | 0.05% | 5,380,300 |

|

7.7% |

Sources: Annual PCRS reports, CSO

The slight uptick in pharmacy numbers this year offers a glimmer of hope after 2023’s first decline, but it is not enough to signal a true recovery. Smaller pharmacies, in particular, are feeling the squeeze, with escalating costs threatening their viability. The Community Pharmacy Agreement 2025 aims to provide targeted investment and structural reforms to safeguard viability and strengthen resilience across the sector.

The number of items reimbursed by the PCRS has continued to rise in 2024, increasing to over 105 million items (see Table 3). This represents a 6.5 per cent year-on-year increase compared to 2023. A growing population and an increase in the number of patients eligible for CDS support are two factors contributing to this growth. Each pharmacy was reimbursed an average of 55,068 items by the PCRS in 2024, which is an increase from the average of 51,724 items in 2023.

This increase reflects the continued demand and growth in operations within the sector, while also underscoring the mounting pressure pharmacies are under. As the number of pharmacies levels off, individual pharmacies will experience an increased workload, requiring larger teams and additional staffing to meet service demands. Rising volumes reaffirm the essential role pharmacies play in healthcare delivery; however, this growth alone is insufficient to ensure financial sustainability.

Table 3: Number of items reimbursed by the PCRS

| Year | No. of items reimbursed (incl. High-Tech and vaccinations) | No. of pharmacies with HSE Contracts | Average number of items reimbursed annually per pharmacy |

| 2019 | 79,269,467 | 1,884 | 42,075 |

| 2020 | 81,426,632 | 1,900 | 42,856 |

| 2021 | 84,788,537 | 1,915 | 44,276 |

| 2022 | 92,422,697 | 1,915 | 48,263 |

| 2023 | 98,843,772 | 1,911 | 51,724 |

| 2024 | 105,290,545 | 1,912 | 55,068 |

Source: Annual PCRS reports.

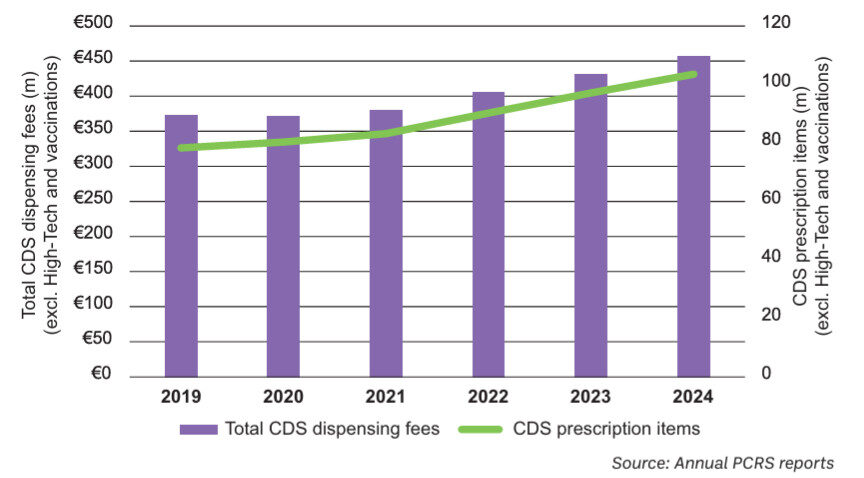

In 2024, the average CDS fee payment per pharmacy (excluding the High-Tech Arrangement and vaccination fees) reached €239,362, reflecting a 5.6 per cent increase from 2023 (see Table 4). This growth was largely driven by a 6.5 per cent rise in the volume of items dispensed, continuing a trend observed since 2022. Consequently, total CDS dispensing fees have increased in-line with the expanding workload for pharmacies (see Figure 1).

Table 4: Average PCRS fee payments to pharmacies

| Year | Total CDS fees (excl. High-Tech and vaccination) | Number of pharmacy contracts | Average CDS fees per pharmacy (excl. High-Tech and vaccination) |

| 2019 | €374.29m | 1,884 | €198,668 |

| 2020 | €372.88m | 1,900 | €196,253 |

| 2021 | €381.71m | 1,915 | €199,326 |

| 2022 | €407.02m | 1,915 | €212,543 |

| 2023 | €433.06m | 1,911 | €226,614 |

| 2024 | €457.66m | 1,912 | €239,362 |

Source: Annual PCRS Reports.

Figure 1: Dispensing fees verses prescription items

Source: Annual PCRS Reports.

When High-Tech patient care fees and immunisation service fees are excluded, the average core CDS dispensing fee per item decreased from €4.46 in 2023 to €4.42 in 2024 (see Table 5). The decline continues despite rising operational costs.

Table 5: Average CDS dispensing fee per item

| Year | Total core dispensing fees (excl. High-Tech and vaccination) | No. of items reimbursed under CDS (excl. High-Tech and vaccination) | Average CDS dispensing fee per item (excl. High-Tech and vaccination) | Percentage decrease since 2019 |

| 2019 | €374.29m | 78,314,344 | €4.78 | |

| 2020 | €372.88m | 80,358,089 | €4.64 | -2.9% |

| 2021 | €381.71m | 83,278,178 | €4.58 | -4.2% |

| 2022 | €407.02m | 90,291,519 | €4.51 | -5.6% |

| 2023 | €433.06m | 97,075,326 | €4.46 | -6.7% |

| 2024 | €457.66m | 103,546,827 | €4.42 | -7.5% |

Source: Annual PCRS Reports.

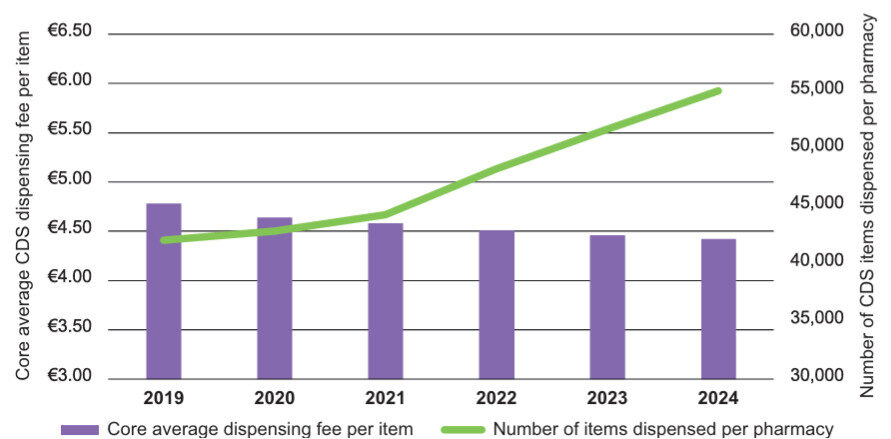

Figure 2 clearly illustrates that as the average number of items dispensed under CDS per pharmacy continues to rise, the core average CDS dispensing fee per item falls due to the regressive fee structure. This trend is particularly concerning in 2024, where the average dispensing fee per item has dropped to its lowest point, and barely covers the labour cost of dispensing one medicine item of €4.23 (Fitzgerald Power, Annual Review of the Community Pharmacy Sector in Ireland 2024/2025).

Meanwhile, pharmacies are dispensing more than ever, over 105 million items, yet are being paid less per item. This position places immense pressure on community pharmacists, with Fitzgerald Power estimating that 6 per cent of pharmacies are operating at a loss and a further 31 per cent are operating with low margins and on the brink of financial unsustainability according to their Annual Review of the Community Pharmacy Sector in Ireland 2024/2025. The increase in core dispensing fees secured under the Community Pharmacy Agreement 2025 will provide some relief for those pharmacies at financial risk, but the underlying pressures remain.

Figure 2: Average CDS dispensing fee verses number of CDS items per pharmacy

Source: Annual PCRS reports

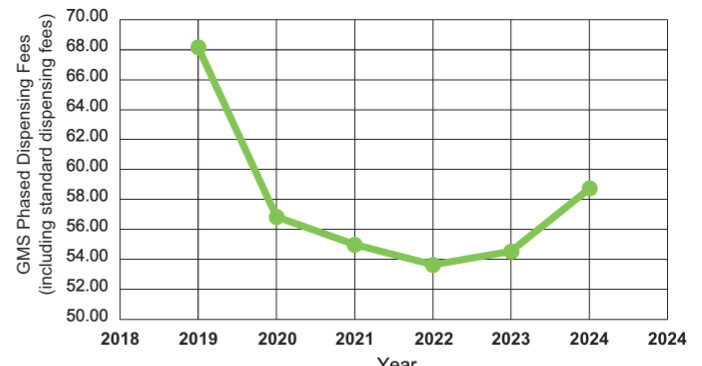

In 2017, the PCRS introduced an approvals process for GMS phased dispensing claiming (PCRS Circular 013/17) to tighten phased dispensing reimbursement due to rising claims. Phasing fees declined steadily over the next five years. However, the trend changed in the last two years, with phased fees raising to €58.73m (including the standard dispensing fees of €5.00/€4.50/€3.50) in 2024 (see Figure 3).

In January 2026, another change will be made to phased dispensing reimbursement by restricting those phased dispensing fees to a defined set of high-risk medications and medications with a potential for misuse. The amounts reimbursed under phased dispensing fees will be monitored and reviewed on an ongoing basis following the introduction of the change. In the event that further savings over those projected are realised, these will be reinvested in the sector.

Figure 3: GMS phased dispensing fees (including standard dispensing fees)

Source: Annual PCRS reports

Payments under this scheme reached €19.21 million in 2024, marking a 30 per cent year-on-year increase compared to 2023. This follows a dramatic 200 per cent rise the previous year. The number of items claimed grew by 37 per cent, driven by the extension of the scheme to relevant women aged between 31-35 years during 2024.

| Scheme | Average cost per item |

| GMS | €15.23 |

| DPS | €18.41 |

| LTI | €31.69 |

| Discretionary Hardship Arrangement | €79.22 |

Source: Annual PCRS reports

Pharmacists are increasingly central to public health, especially in vaccination. By providing extra services that patients greatly value, pharmacists have taken on an ever-expanding role in recent years. This aligns with the findings of the IPSOS B&A Pharmacy Usage & Attitudes Survey 2025 which found that that almost nine in ten people are comfortable with the idea of being vaccinated in a pharmacy.

Payments for vaccination services have doubled since 2020, reaching €19.06 million in 2024. The influenza vaccine service alone saw a 41 per cent increase in payments compared to 2023 (to €13.13 million), suggesting growing public engagement and more pharmacists operating off-site LAIV clinics. Meanwhile, payments for the COVID-19 vaccination service dropped to €5.93 million as demand waned, representing a 40 per cent decrease from 2023.

The Community Pharmacy Agreement 2025 introduces expanded opportunities for pharmacies to deliver vaccination services. The new agreement will allow pharmacists to be funded to administer the pneumococcal polysaccharide vaccine (PPV23), as well as the opportunity to support catch-up vaccination programmes and the Schools Immunisation Programme.

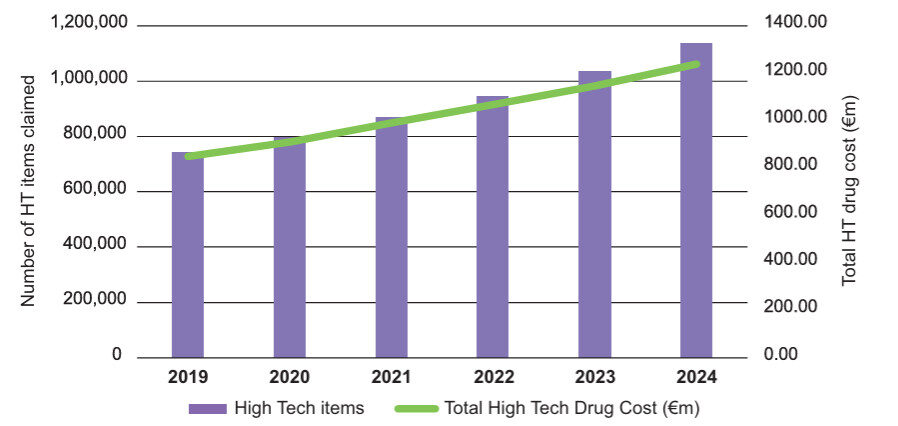

The volume of items dispensed under the High-Tech Arrangement continues to rise as more reimbursable items are added to the arrangement and more patients are prescribed High-Tech medicines (see Figure 4). The volume of items dispensed increased from 744,377 in 2019 to 1,134,482 in 2024 (+54 per cent), largely driven by the number of patients dispensed High-Tech medicines increasing from 88,748 to 135,358 (+53 per cent), over the same period.

The High-Tech drug costs paid to wholesalers and manufacturers have correspondingly risen from €849.22 million in 2019 to €1,238.73 million in 2024. The majority of this spending is on antineoplastic and immunomodulating agents, which account for 76 per cent of all High-Tech expenditure. The average cost of a medicines dispensed under the High-Tech Arrangement also increased by 14 per cent from €957.12 in 2019 to €1,091.89 in 2024.

Figure 4: Number of Items and Expenditure under the High-Tech Arrangement

Source: Annual PCRS reports

As pharmacy numbers stabilise, individual pharmacies face growing workloads, requiring larger teams and additional staff to maintain service standards and meet patient expectations. This would be expected to drive the need for staff training. Yet, despite the availability of the HSE Pharmacy Training Grant, uptake of the grant has remained low, with only €486,499 out of a potential €2.4 million being claimed for in 2024.

Barriers include limited awareness, administrative complexity, a narrow range of covered courses and a lack of reimbursement of pharmacists’ time taken to take part in training. The Community Pharmacy Agreement 2025 aims to address these issues, aligning training with national health priorities and supporting professional development across the sector.

Total PCRS payments and reimbursements during 2024 were approximately €4,399.90 million. This was a €326.63 million increase compared to 2023, driven substantially by increased medicines costs, namely for CDS medicines, High-Tech medicines and hospital oncology medicines.

The PCRS administration costs increased by 21.5 per cent between 2023 and 2024, from €50.82 million to €61.74 million. This reflects the growing complexity of community drug schemes, policy decisions shifting private care to state-funded care, and the administrative workload required under the Health (Pricing and Supply of Medical Goods) Act 2013.

The data from 2024 leaves no doubt: dispensing activity in Ireland’s community pharmacies is on a steady upward trajectory, and all signs point to continued growth in the years ahead. With over 105 million items reimbursed this year — a 33 per cent increase since 2019 — pharmacies are serving more patients and handling more prescriptions than ever before.

This expansion, however, is not driven by population growth alone, with policy decisions playing a significant part. Initiatives like the reduction in the Drug Payment Scheme threshold and the introduction of the Free Contraception Scheme have contributed to higher volumes and greater public access. Yet, these same policies have shifted more business from private to State-funded dispensing, often at lower reimbursement rates and with increased administrative demands.

Looking ahead, the Community Pharmacy Agreement 2025 represents a pivotal moment for the sector. While it promises targeted investment, structural reforms, expanded clinical roles for pharmacists and statutory pharmacy fee reviews in June 2026 and June 2029, it will take time for these benefits to be fully realised. It is likely to be the end of 2025 before the positive impacts of the agreement are felt on the ground.

For more information, please contact the IPU Contract Unit at contract@ipu.ie.

This article is based on the PCRS Statistical Analysis of Claims and Payments Annual Report 2024 and all data and insights are drawn from the report. The report is available here.

Zrinka Bulj

Claims Analyst, IPU

Highlighted Articles