Home » How secure is a pharmacist’s income?

You invest time into looking after your customers every day, but take a moment to think about how secure your current financial status would be if you were unable to work due to accident, illness or a disability.

Week after week, the income a pharmacist earns goes to pay for your mortgage repayments/rent, your bills, your car, your children’s education and care. Your income also pays for your holidays and all the other things that go to make up the life you are living right now. It’s the least you deserve —

to enjoy the things you work so hard to pay for. So what would happen if, almost without warning, that money was no longer there?

Your employer/pharmacy may provide a short-term payment scheme if you are out of work due to ill health for a week or two and the Government has you covered with social welfare benefits — so no need to worry right? Well, the reality may be somewhat different. Most employers have only short-term payment schemes in place. How long would your personal savings last if you were unable to work for three months or more? The State Illness benefit for 2024, is only € 232 per week. An adult dependant is usually your spouse, civil partner, or cohabitant. Could you or your family live on this as your only income? Furthermore, if you are self-employed/locum pharmacist, you are not entitled to State benefit — a sobering thought.

In general, we tend to be over-optimistic when it comes to insuring the things that matter, and for many insuring your income may seem redundant. However, given that your income pays for just about everything — your mortgage, car loan, bills, children’s education, other insurances — perhaps it’s time we take the idea of insuring your salary seriously.

Income Protection is a very straightforward product which pays you an income if the

unexpected does happen and you are unable to earn an income due to illness or injury. With Income Protection you simply pay a monthly premium (which qualifies for tax relief at your marginal rate) based on the amount of your income which you want to cover, the level of benefits you require and the state of your health. Then, if you suffer any illness, injury or disability which prevents you from working and earning an income, your Income Protection policy will pay you a replacement income of up to 75% of your salary until such time as you are fit to return to work or until you retire.

It is important to note that unlike Critical or Serious Illness Cover, which covers you for a limited set of specified illnesses, Income Protection covers you for any illness or injury, including mental illness, cancer, slipped disks and multiple sclerosis.

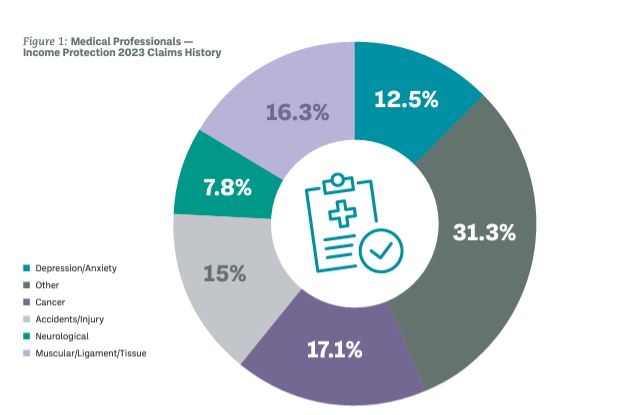

Figure 1: Medical Professionals — Income Protection 2023 Claims History

Income Protection can be designed to fit your specific needs. You can usually choose a deferred or waiting period of between one month and a year, and you also have the option of index-linking your payments and benefits so that your policy keeps pace with your lifestyle. If you are not working, very often you will find that your financial needs are lower so, depending on your commitments, you can choose to protect up to 75% of your salary.

The cost of income protection insurance for pharmacists can vary depending on factors such as the individual’s age, health status, and the level of coverage desired. Smokers and individuals with pre-existing health conditions may pay higher premiums. Premiums are guaranteed.

Income Protection is an essential component of a comprehensive financial plan, offering peace of mind and security in the face of life’s uncertainties. By safeguarding your income against unexpected events.

Omega Financial Management can help you to choose and customise an Income Protection policy that delivers complete peace of mind when you are healthy, and also delivers the financial and rehabilitation support you’ll need if the unexpected does happen and you suffer a serious illness or injury that leaves you unable to work. Contact Declan Egan, Senior Account Executive on 087 222 0188, or at declan@omegafinancial.ie.

Declan Egan

Senior Account Executive, Omega Financial Management

Highlighted Articles