Home » Economics: Looking ahead to 2024

In his economic and financial update this month, economist Jim Power reflects on the impact of global political uncertainty on the economic outlook for the year ahead and outlines the key positives, and challenges, for the domestic economy.

Intense uncertainty is the key theme in the global economy now. While headline inflation rates are decelerating, inflation has continued to be quite stubborn; interest rates are at elevated levels; global economic growth is under pressure to varying degrees; and the global geo-political backdrop is very dangerous and very uncertain. Political developments do have significant economic impacts, so there is cause for caution now.

There are somewhat contrasting growth pictures evolving. On the one hand the US economy expanded by a robust 4.9 per cent in the third quarter. On the other hand, growth in the Euro Zone contracted by 0.1 per cent in the third quarter, with Germany contracting by 0.1 per cent also. The UK economy stagnated in the third quarter, with growth unchanged from the previous quarter. High borrowing costs are hitting UK business investment and the elevated cost of living is undermining consumer expenditure. Compared with the final quarter of 2019 (pre-COVID), the UK economy has grown by just 1.8 per cent, compared to 7.4 per cent in the US and 2.9 per cent in the Euro Zone.

| Region | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 |

| Euro Zone | 0.0% | 0.0% | +0.2% | -0.1% |

| Germany | -0.4% | 0.0% | +0.1% | -0.1% |

| France | 0.0% | +0.1% | +0.6% | +0.1% |

| Italy | -0.2% | +0.6% | -0.4% | 0.0% |

| Spain | +0.5% | +0.6% | +0.4% | +0.3% |

| Netherlands | +0.9% | -0.4% | -0.2% | -0.2% |

| Ireland | -0.9% | -2.6% | +0.5% | +1.8% |

| United Kingdom | +0.1% | +0.3% | +0.2% | 0.0% |

Three key central banks decided to leave interest rates unchanged at their most recent policy meetings. This is a justifiable recognition of the cumulative tightening already delivered in this cycle; a gradual easing of measured inflation; and significant economic weakness, particularly in the Euro Zone. However, the heightened geopolitical uncertainty resulting from the ongoing war in Ukraine; and the war between Israel and Hamas, and the risks that it could very easily evolve into a general conflict in the Middle East would also have influenced the decision not to tighten any further.

At their meeting on 26 October, the ECB left interest rates unchanged after 10 successive rate increases. The ECB president said that interest rates are, “at levels that, maintained for a sufficiently long duration, will make a substantial contribution” to bringing inflation down to the target. It is likely that ECB rates have peaked, and a loosening of policy is likely to become more realistic as 2024 progresses.

At the 1 November FOMC (Federal Open Market Committee) meeting, the US Federal Reserve left its key policy rate unchanged at a 22-year high of between 5.25 per cent and 5.5 per cent. The Chairman stressed that additional rate increases would very much remain an option if economic conditions warranted it. The reality is that the Fed is likely done with rate tightening in this cycle and the focus is now most likely on how long rates should remain at current highs, rather than how high rates should go.

The Bank of England left rates unchanged at a 15-year high of 5.25 per cent at the meeting of the Monetary Policy Committee (MPC) on 2 November, for the second meeting in a row. The Bank of England expects inflation to drop in 2024 and to reach 1.9 per cent in two years. Making such inflation predictions is foolish, but it does suggest that the Bank now believes it has probably done enough on the tightening side. However, it is clear in its view that rate cuts are a long way away. It is also suggesting that if inflationary pressures persist, further tightening could not be ruled out. This is a consistent message from most central bankers now.

Despite these global developments, the Irish economy continues to perform quite strongly, with the labour market, tax revenues and consumer spending all suggesting ongoing reasonable levels of economic activity. The export performance of the multi-national sector is undergoing a significant downward adjustment after a prolonged period of extreme buoyancy. This will undermine the GDP performance in 2023 and 2024 but will also likely impact on corporation tax revenues and employment.

Looking ahead to 2024, the outlook for Ireland looks less positive than in recent years. The global economic background is likely to prove challenging; the impact of cumulative rate increases since July 2022 have yet to be fully felt; and the elevated level of consumer prices is undermining the consumer sector.

In such an uncertain and volatile global economic and political environment, trying to make definitive forecasts is not likely to prove very fruitful. Instead, it is worth considering the positive and negative forces at play.

The key positives for the economy include:

Despite these global developments, the Irish economy continues to perform quite strongly, with the labour market, tax revenues and consumer spending all suggesting ongoing reasonable levels of economic activity.”

The key threats and challenges to the wellbeing of the economy include:

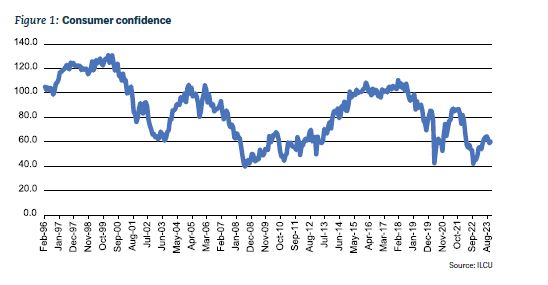

Consumer confidence has been somewhat fragile in the past number of months, with rising interest rates and the escalated cost of living impacting. Consumer spending has slowed. In the first nine months of the year, the value of retail sales increased by 10.2 per cent, but when car sales are excluded, the value of sales increased by 5 per cent. New car sales are up by 15.5 per cent so far in 2024. In volume terms, overall retail sales have increased by 5.3 per cent, but by just 1.3 per cent when car sales are excluded.

Source: ILCU

The headline rate of inflation continues to gradually ease, but it is still well above the targeted rate of 2 per cent. The annual rate of price increase decelerated to 5.1 per cent in October, down from a peak of 9.2 per cent a year ago. The headline rate of inflation is expected to gradually ease during 2024, with an average rate of around 3 per cent possible. The big imponderable will be energy prices, with the risks to prices from the war in Ukraine and Gaza key elements of uncertainty.

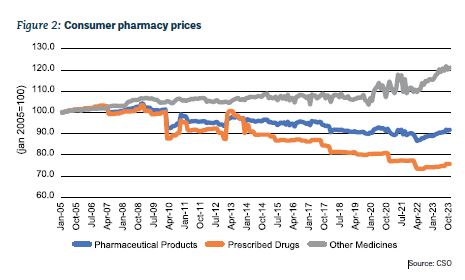

In the year to October, the average consumer price of pharmaceutical products increased by 3.2 per cent, with prescribed drug prices increasing by 2.2 per cent and the price of other medicines up by 5 per cent. Inflation in the pharmacy sector is still lagging the rest of the economy.

Consumer pharmacy prices

Source: CSO

Jim Power

Economist

Highlighted Articles