Home » Economics: Community pharmacy is a key element of primary healthcare

The operating environment for community pharmacy has been intensely challenging in recent years, with a massive escalation in the costs of doing business, but a government fee that hasn’t changed since 2009. In this article, independent economist Jim Power looks at the future viability of community pharmacy.

The provision of affordable healthcare is a challenge faced by every government in the world, and Ireland is no different in that regard. Ireland’s demographics are characterised by a growing population and an ageing population. In Census 2022 there was 781,400 people aged 65 years or older and this is projected to increase to between 1.38 million and 1.41 million by 2042, based on CSO population projections.

The healthcare implication of a growing and ageing population is that the demand for services will increase exponentially. The State will struggle to deliver the level and quality of healthcare that the population expects.

An integrated healthcare system is essential and primary healthcare provision will have to play an ever-greater role in the health service. The OECD recognises that effective primary healthcare is the cornerstone of an efficient, people-centred, and equitable health system. Community pharmacies already play a vital role in primary healthcare provision in Ireland, but they will have to play a more significant role across all communities over the coming decades. That is of course if we still have community pharmacies across the country. Based on the economics of the sector now, that is a matter of considerable uncertainty and debate.

OECD data show that in Ireland 83 per cent of expenditure on retail pharmaceuticals is covered by government schemes. This creates a challenge for pharmacies as they are unable to pass on rising operational costs to the customer.

The fee structure is a problem. In the past community pharmacy fees were index linked to general pay increases for civil servants, but this index linking was stopped when FEMPI legislation was enacted in 2009.

Table 1 below shows the growth in average consumer prices between December 2009 and December 2024. Over that period, average consumer prices increased by 29 per cent; private rents increased by 127.2 per cent; the cost of postal services increased by 92.5 per cent; doctors’ fees increased by 27.8 per cent; dental services increased by 37.2 per cent; and health insurance increased by 164.5 per cent. In contrast, the average cost of pharmaceutical products declined by 6.6 per cent, with the price of prescribed drugs declining by 23.5 per cent.

As an example, the price of a postage stamp was 55 cent in 2010, and it is increasing to €1.65 in 2025. Such increases are necessary to maintain the viability of post offices. In contrast, community pharmacies are in an environment characterised by price compression due to Government fee policy.

Table 1: Change in consumer prices between December 2009 and December 2024

| ITEM | % CHANGE |

| Consumer Price Index | 29.0% |

| Food | 9.3% |

| Clothing | -26.1% |

| Private rents | 127.2% |

| Electricity | 121.5% |

| Gas | 148.0% |

| Health | 21.8% |

| Pharmaceutical products | -6.6% |

| Prescribed drugs | -23.5% |

| Other medicines | 22.5% |

| Doctors’ fees | 27.8% |

| Dental services | 37.2% |

| Petrol | 49.9% |

| Diesel | 58.9% |

| Taxi fares | 32.1% |

| Postal services | 92.5% |

| Cinema | 13.3% |

| Restaurants and hotels | 43.0% |

| Hairdressing | 36.6% |

| Insurance connected with health | 164.5% |

| Motor insurance | 11.7% |

Source: CSO PxStat

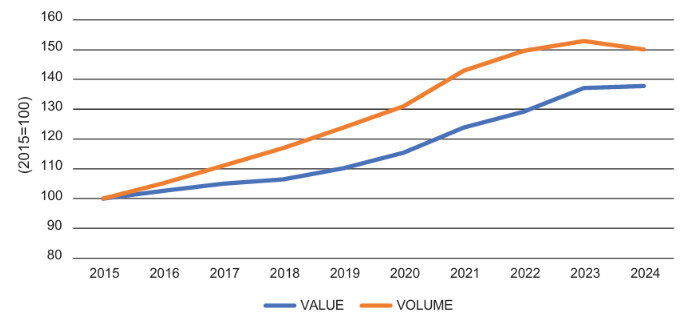

Figure 1: Retail sales of pharmaceutical, medical and cosmetic items

Source: CSO PxStat

Figure 1 shows the trend in retail sales of pharmaceutical, medical and cosmetic items between 2015 and 2024. The volume of sales increased by 50.1 per cent over that period, but the value of sales increased by a lesser 37.8 per cent. Pharmacies are selling more in volume terms, but the value of what is being sold is lagging. This is indicative of the price compression in the pharmacy sector.

As stated earlier, in the past community pharmacy fees were index linked to general pay round increases for civil servants, but this indexation ended in 2009. Table 2 shows the growth in average hourly pay both in total and when irregular earnings are excluded for a range of public sector roles and for an average private sector worker.

Table 2: Percentage change in average hourly pay between Q1 2010 and Q3 2024

| Average hourly pay | Average hourly pay — excluding irregular earnings | |

| Civil service | 16.6% | 16.4% |

| Defence | 31.9% | 33.5% |

| Garda Siochana | 28.5% | 33.9% |

| Education | 30.1% | 30.1% |

| Regional bodies | 14.0% | 14.3% |

| Health | 28.6% | 30.9% |

| Private Sector | 36.1% | 36.3% |

| Public Sector | 25.5% | 26.7% |

Source: CSO PxStat

If Government fees to pharmacies had been linked to linked to civil service pay an increase of 16.4 per cent would have been delivered. If linked to other public sector roles, the fee increase would have been significantly greater.

The freezing of fees for community pharmacies has occurred at a time when the costs of running a pharmacy have been increasing at a significant pace. Table 2 shows that average private sector pay increased by 36.1 per cent between the first quarter of 2010 and the third quarter of 2024.

The operating environment for many community pharmacies has been intensely challenging in recent years. There has been a massive escalation in the costs of doing business, including energy costs, insurance costs, labour costs, and compliance costs. Like the retail sector in general, pharmacies are labour intensive, so labour costs and other labour market regulations in areas such as paid sick days and parental leave impose an inordinate financial and logistical burden. The introduction of auto-enrolment for pensions later this year will further exacerbate the cost pressures. For example, in December 2024 the average consumer price of electricity was 121.5 per cent higher than in December 2009.

There is official recognition of the elevated costs of doing business in Ireland. The National Competitiveness and Productivity Council (NCPC) pointed out in July 2024 that:

“While the Irish economy has demonstrated resilience through the current period of global uncertainty with employment levels reaching a record high, the cost of doing business has been increasing. Over the last number of years, the Government has introduced or progressed several initiatives to improve working conditions, making the Irish workplace more attractive for employees and helping to bring minimum working conditions in Ireland in line with EU countries. However, the introduction of these measures does not come without costs to firms. Among the most affected sectors, will be those employing large numbers of staff, and operating on relatively slim margins. This includes –— for example — firms operating in hospitality and retail. In addition, energy, transport and shipping costs remain elevated which continues to pose competitiveness challenges to Ireland as an open economy.”

The reality is that most of the business of community pharmacies, i.e. medicine prices and dispensing fees, are set by Government, so community pharmacy has a very limited ability to compensate for the increased cost of doing business. Furthermore, the front of pharmacy shop goods and their pricing operates in a very competitive retail space.

Jim Power is an independent economist and co-host of The Other Hand podcast.

Jim Power

Economist

Highlighted Articles