Home » Economic update for the pharmacy sector

There is currently a reasonable level of optimism about the global growth outlook, despite the myriad of geo-political risks that abound. Global inflation has come down more quickly than expected, with the headline rate currently at 2.4 per cent in the Euro Zone and 3.4 per cent in the US. Inflation in most countries has not yet achieved the preferred level of 2 per cent, but it continues to edge in that direction.

The Euro Zone economy experienced a mild technical recession in 2023 but returned to growth in the first quarter of this year. In the first quarter, GDP in Germany expanded by 0.2 per cent, it expanded by 0.2 per cent in France, by 0.7 per cent in Spain and by 0.3 per cent for the Euro Area as a whole. While these growth rates do suggest economic recovery, the reality is that in the first quarter of 2024, Euro Zone GDP was just 0.4 per cent higher than the first quarter of 2023. There is still some distance to go before the Euro Zone economy approaches a level of growth close to potential, but things are getting better. The UK economy also emerged from recession in the first quarter, with GDP expanding by 0.6 per cent.

The latest forecast from the IMF (April 2024) was mildly upbeat. The IMF believes that global growth will be a bit stronger over the coming year, helped by lower energy prices, interest rates and inflation.

Table 1: Global economic outlook

Source: IMF, April 2024

The risks to global growth are reasonably clear. They mainly revolve around global geo-politics. It is a very big year for elections around the world, with the European parliamentary elections in June and the United States election in November, arguably the most important. The performance of the far-right in Europe and Trump in the United States will need to be watched very carefully. In addition, there are a lot of wars going on around the world, with Gaza and Ukraine the highest profile, but areas like Sudan are also going through hell. In summary, the global geo-political backdrop is very risky. The risks include a further energy price shock; a more dangerous deterioration in the relationship between the US and China; and further threats to free trade and globalisation.

One of the dominant themes in markets now concerns the timing and magnitude of interest rate cuts. Over the past six months market sentiment has gyrated wildly in relation to the path of interest rates. It now appears that the Federal Reserve will not cut for some time as the US economy is still proving resilient and there is no reason to cut rates. The Euro Zone rate outlook appears somewhat clearer. Although recovering, the Euro Zone economy is still quite tepid, and it is likely that the ECB will start to gradually loosen monetary policy from June onwards. It is always difficult to precisely predict the path of interest rates, but the evidence suggests that rates will come down. It is not likely that ECB rates will go back to the historical lows of recent years, but it is possible that the ECB will cut up to 2 per cent off its rates over the next 18 months. Much will be dependent on data and price pressures.

The Irish economy continues to perform at a reasonable pace in 2024. The flash estimate of GDP for the first quarter expanded by 1.1 per cent, suggesting that the technical GDP recession ended.

The labour market remains tight with record levels of employment of 2.7 million at the end of last year and a virtually full-employment level of unemployment at 4.4 per cent in April. Tax revenues are also holding up quite well, and the export performance is rebounding after a sharp post-COVID reversal in 2023, mainly in the pharma sector.

The Department of Finance has just published its Stability Programme Update. It believes that data published since its autumn assessment present mixed signals, but on balance, the evidence points to an economy that is in reasonable shape, at least in aggregate terms. It pointed out that some areas of the economy, especially the labour market, remain resilient, and that inflation is easing faster than anticipated. However, it pointed out that there has been some loss of momentum in areas such as consumer spending and private sector investment.

The SME sector is a vital component of the Irish economy and is particularly important for regional employment and general economic activity. In 2021 there were 349,338 SMEs operating in the Irish economy, accounting for 99.8 per cent of business enterprises in Ireland. These SMEs employed 1.3 million employees, which is equivalent to 69.2 per cent of business employment in the economy.

Of the 349,338 SMEs, 92.8 per cent employed less than 10 people; 6.1 per cent employed between 10 and 49 people; and 1.1 per cent employed between 50 and 249 people.

The SME sector, particularly those operating in hospitality and retail, are finding the business environment challenging now. Several measures have been or are about to be introduced that are adding significantly to the cost of doing business. These measures include the increase in the national minimum wage of 12.4 per cent on January 1st; the progression towards a living wage of €15 per hour by 2026; the increase in the VAT rate from 9 per cent to 13.5 per cent on 1st September 2023; statutory sick pay changes; parental leave changes; the extra bank holiday; higher PRSI; and auto-enrolment for pensions. The measures will combine to increase costs significantly for SME businesses across diverse sectors. These businesses were already under significant pressure due to higher energy costs, higher food prices, labour shortages, and other input costs.

The Government has responded with a package of measures aimed at easing pressures on the SME sector.

In the pharmacy sector, inflationary pressures have remained quite muted. In the year to April, the price of pharmaceutical products increased by 3 per cent, with prescribed drug prices increasing by 1.9 per cent, and the price of other medicines increasing by 4.7 per cent. The period since the beginning of 2021 can be characterised as the cost-of-living crisis period. Between January 2021 and April 2024, the overall average price level has increased by 19.8 per cent, but over the same period the price of pharmaceutical products increased by 4.2 per cent, with prescribed drug prices declining by 1.6 per cent, and the price of other medicines increasing by 14.1 per cent.

Personal finances

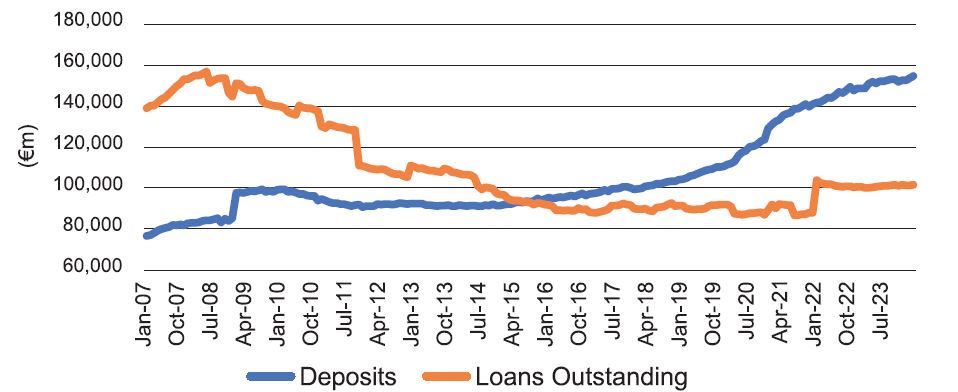

The household balance sheet is in a very strong position. In March 2024 household deposits totalled €154.6 billion, and household credit outstanding stood at €101.6 billion, of which mortgage credit outstanding totalled €84.1 billion. This is in marked contrast to the situation in 2007 when credit outstanding far exceeded household deposits. The situation pivoted in 2015. This is a very positive fundamental factor for the personal sector. However, the aggregate data do not tell the whole story, as the deposit total is concentrated in a certain age segment. For the younger age profile, the cost and availability of housing to rent or buy represents a serious financial challenge.

Figure 1: Household balance sheet

Source: Central Bank of Ireland

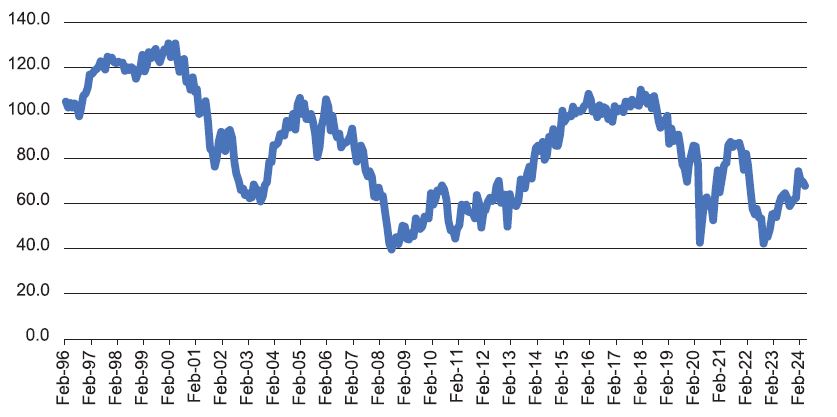

Consumer confidence improved moderately during 2023. However, consumer sentiment was pressurised by rising interest rates and cost-of-living pressures during the year. However, these negative impulses were offset by the strong labour market; solid growth in earnings; and a growing belief that interest rates have peaked. Between February and April 2024, consumer sentiment has weakened modestly, mainly reflecting cost-of-living pressures.

Figure 2: Consumer confidence Source: ILCU/Core

Source: ILCU/Core

In 2023, the volume of retail sales expanded by 4.2 per cent, but when car sales are excluded, the growth in the volume of sales increased by just 1 per cent. In the first quarter of 2024, the volume of retail sales increased by 2.6 per cent, but when car sales are excluded, the growth rate was a more modest 1.2 per cent.

In the first quarter of 2024, the volume of retail sales was 2.6 per cent higher than a year ago. Excluding motor sales, which have been strong so far in 2024, the volume of retail sales was 1.2 per cent higher than a year earlier. Consumer spending has slowed in the face of cost-of-living pressures but is still reasonably solid.

In the pharmacy sector the volume of retail sales of pharmaceutical, medical, and cosmetic items was 1.7 per cent lower than the first quarter of 2023. The retail environment is challenging.

Jim Power hosts a popular podcast called ‘The Other Hand’.

Jim Power

Economist

Highlighted Articles