Home » Annual Review of the Community Pharmacy Sector

Health spending will continue to make up a greater part of Government spending into the future as Ireland’s population ages and the tax base declines as a share of the population. Paying for an ageing population will be the biggest budgetary dilemma of the coming decades, so finding long-term solutions is vital. Policies we choose today will have an impact ten years from now, both negative and positive.

The State has saved approximately €7.3 billion from reduced medicine reimbursements and pharmacy fee renumeration since 2009, including over €1 billion directly from cuts to community pharmacists’ fees and markups. Despite these savings, pharmacies have not seen a corresponding investment or fee restoration.

In January of this year the Irish Pharmacy Union commissioned Fitzgerald Power to carry out an economic study of the Irish community pharmacy sector.

This is what we found.

Trading conditions have become increasingly difficult for Irish pharmacies since 2009 as reductions in community drug scheme revenues and increasing operational costs, particularly those relating to labour, have resulted in lower profitability.

The average total revenue of a community pharmacy in Ireland decreased over the period 2009 – 2023 by 20.75 per cent, and core income from community drug schemes decreased by 24.87 per cent, from €1,277,120 in 2009 to €959,482 in 2023, as detailed in Figure 1.1. Over that period, declining community drug scheme income was somewhat negated by improving OTC/FOS sales, but there is evidence this trend is reversing.

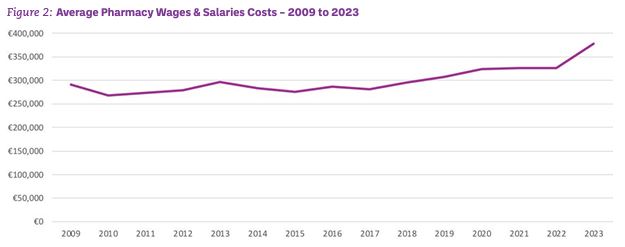

Since 2009 and the implementation of the Financial Emergency Measures in the Public Interest Act (FEMPI) fee reductions, community pharmacy contractors have faced significantly increased operational costs, particularly in wages, utilities, and rent. The average wage cost for dispensing one item has increased by 19 per cent since 2009, from €3.73 to €4.44 in 2023.

Over this period community pharmacists have not received any fee increases, unlike other healthcare professionals who have seen their pay restored. General Practitioners, for example, have received significant reinvestment through recent GP agreements, highlighting the disparity in treatment.

Expenditure on wages and salaries continued to rise, from €291,200 per pharmacy in 2009 to €386,231 in 2023, an increase of c€95,000 or 32.63 per cent. Rising employment costs continue to account for a greater proportion of a pharmacy’s revenue base. If the proportional spend on wages and salaries had remained constant over the review period, labour costs in 2023 would have been €230,780. This is a saving of c€155,000 on the actual 2023 cost.

Our survey of the sector found that pharmacists are working harder as their costs per item are increasing, while their profit per unit is declining. The complexity and administrative workload associated with community drug schemes has increased substantially, yet there has been no compensation for these additional burdens.

The current fee structure for community drug schemes has resulted in approximately 10 per cent of pharmacies operating at a loss and c30 per cent operating with low operating profits, which puts a large part of the owner-operator business model at risk. Without an increase in fees, and ongoing indexation of state renumeration many pharmacies are at risk of becoming financially unviable, potentially leading to closures.

We have calculated that roughly 500 pharmacies will have closed by 2029 if there is not action taken to support lower operating profit pharmacies. These pharmacies will not be evenly distributed across the country and so any closures will impact already under-served regions disproportionately.

Since smaller revenue pharmacies disproportionately serve underserved communities, the disappearance of a greater number of these pharmacies will lead to knock on negative consequences as isolated populations lose access to local pharmacies. Other parts of the health service will need to step in to fill the gap.

It is clear policymakers will need to reinvest in the community pharmacy sector to ensure the viability of this network of accessible healthcare professionals. As the important part of this decline is driven by rising costs, particularly in relation to wages, and a reduction in revenue due to the regressive fee structure, the solutions are to fix one or both, of these issues.

Community pharmacists have not received any fee increases since the FEMPI reductions, unlike other healthcare professionals who have had their pay restored. General Practitioners, for example, have received significant reinvestment through recent GP agreements, highlighting the disparity in treatment.

The current financial strain limits pharmacies’ ability to invest in and expand their services. Adequate funding is necessary to maintain and enhance the role of pharmacies in delivering healthcare, which is crucial for achieving broader healthcare goals, such as those outlined in Sláintecare. Expanding renumerated services to the sector would enable greater utilisation of resources across the health service.

It would help to stabilise the sector, protect community-based healthcare, and keep young people interested in a profession that has proven itself to be a vital part of the healthcare infrastructure.

The Annual Review of the Community Pharmacy Sector in Ireland 2022/23 is available to IPU members at ipu.ie > News and Publications > Submissions and Reports.

Stuart Fitzgerald

CEO, Fitzgerald Power

Highlighted Articles