Home » Annual Review of the Community Pharmacy Sector

The IPU commissioned Fitzgerald Power and the economist Jim Power to carry out an economic study of the Irish community pharmacy sector in early 2023. In this article Stuart Fitzgerald, CEO of Fitzgerald Power, provides an overview of the findings of the study, which were published in June as the Annual Review of the Community Pharmacy Sector in Ireland 2022/23.

The Irish community pharmacy sector finds itself in a delicate position. Our expanding aged population together with an increase in lifestyle conditions means the volume of medicine dispensing in Ireland is growing every year.

Approximately 80% of all medicines in Ireland are dispensed to patients under one of the State’s Community Drug Schemes. Therefore, the State is the pharmacy sector’s largest customer, and this customer hasn’t increased the fees it pays to pharmacists for dispensing medicines since 2009. Pharmacists’ costs are rising, and one might expect that these rising costs would be passed on to the State. But this isn’t a normal market.

Twenty-five pharmacies went out of business in 2022, according to figures published by the Pharmaceutical Society of Ireland. If this is the beginning of a trend, we may see fewer pharmacies and reduced access to clinical care in our communities.

In January of this year the Irish Pharmacy Union commissioned Fitzgerald Power and the economist Jim Power to carry out an economic study of the Irish community pharmacy sector.

This is what we found.

It’s a broad statement, but in general terms economic performance in Ireland has been very strong in recent years. The Irish economy has proven to be resilient in the face of several international headwinds including COVID, Brexit and the Ukrainian crisis. Most sectors of the economy benefited from this period of economic growth, however, recently inflation has become a key challenge for households and businesses.

Between 2009 and 2022 the CPI increased by 16.1%, however, the price of pharmaceutical products fell by 13.1% and the value of prescribed drugs declined by 25.7%:

| Average CPI: 2009 – 2022 | +16.1% |

| Average price of pharmaceutical products: 2009 – 2022 | -13.1% |

| Average price of prescribed drugs: 2009 – 2022 | -25.7% |

| Average price of other medicines: 2009 – 2022 | +6.5% |

Individuals employed by the State benefited from increases in hourly rates of pay, which is to be expected in a prosperous and growing economy.

| Total average hourly earnings health workers | |

| Q4 2009 – Q4 2022 | +14.2% |

| Total average hourly earnings civil servants | |

| Q4 2009 – Q4 2022 | +12.4% |

| Total average hourly earnings Garda Siochana | |

| Q4 2009 – Q4 2022 | +32.4% |

The pharmacy sector did not benefit from the rising tide, and is the only part of the healthcare sector not to receive a restoration of their pay. Trading conditions have become increasingly difficult for Irish pharmacies since 2009 as reductions in community drug scheme revenues and increasing operational costs, particularly those relating to labour, have resulted in lower profitability.

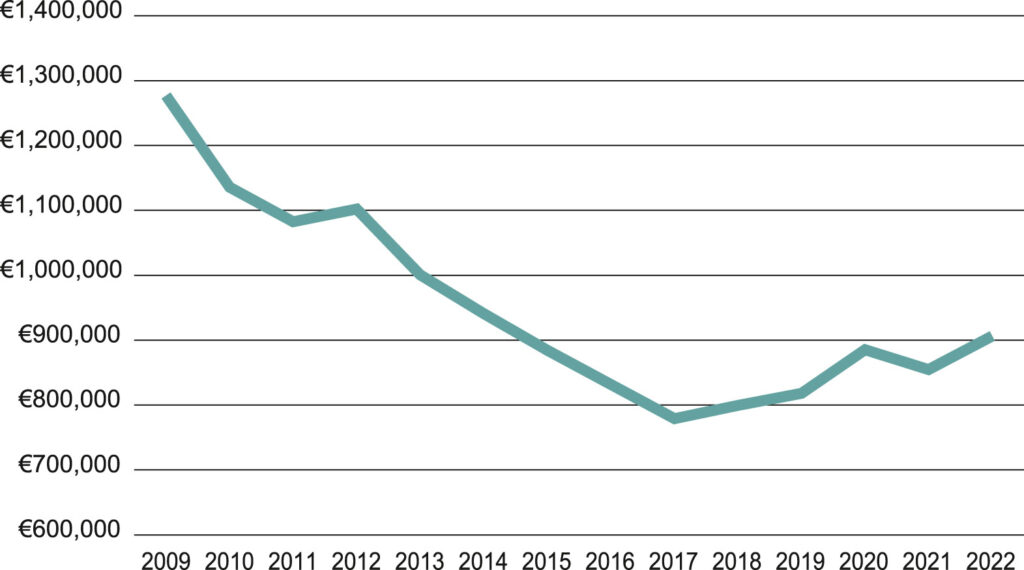

The average total revenue of community pharmacies in Ireland decreased over the period 2009 – 2022 by 24.12%, and core income from community drug schemes decreased by 29%, from €1,277,120 in 2009 to €906,651 in 2022, as detailed in Figure 1.

Figure 1: Average Community Drug Scheme Pharmacy Revenue — 2009 to 2022

“The average total revenue of community pharmacies in Ireland decreased over the period 2009 – 2022 by 24.12%.”

This decrease has been partly offset by COVID-19 vaccination income, which generated nearly €26 million in revenue in 2022, but is not expected to continue at the 2022 level — and gains from increased retail activity which are threatened by e-commerce and competition from discount supermarkets.

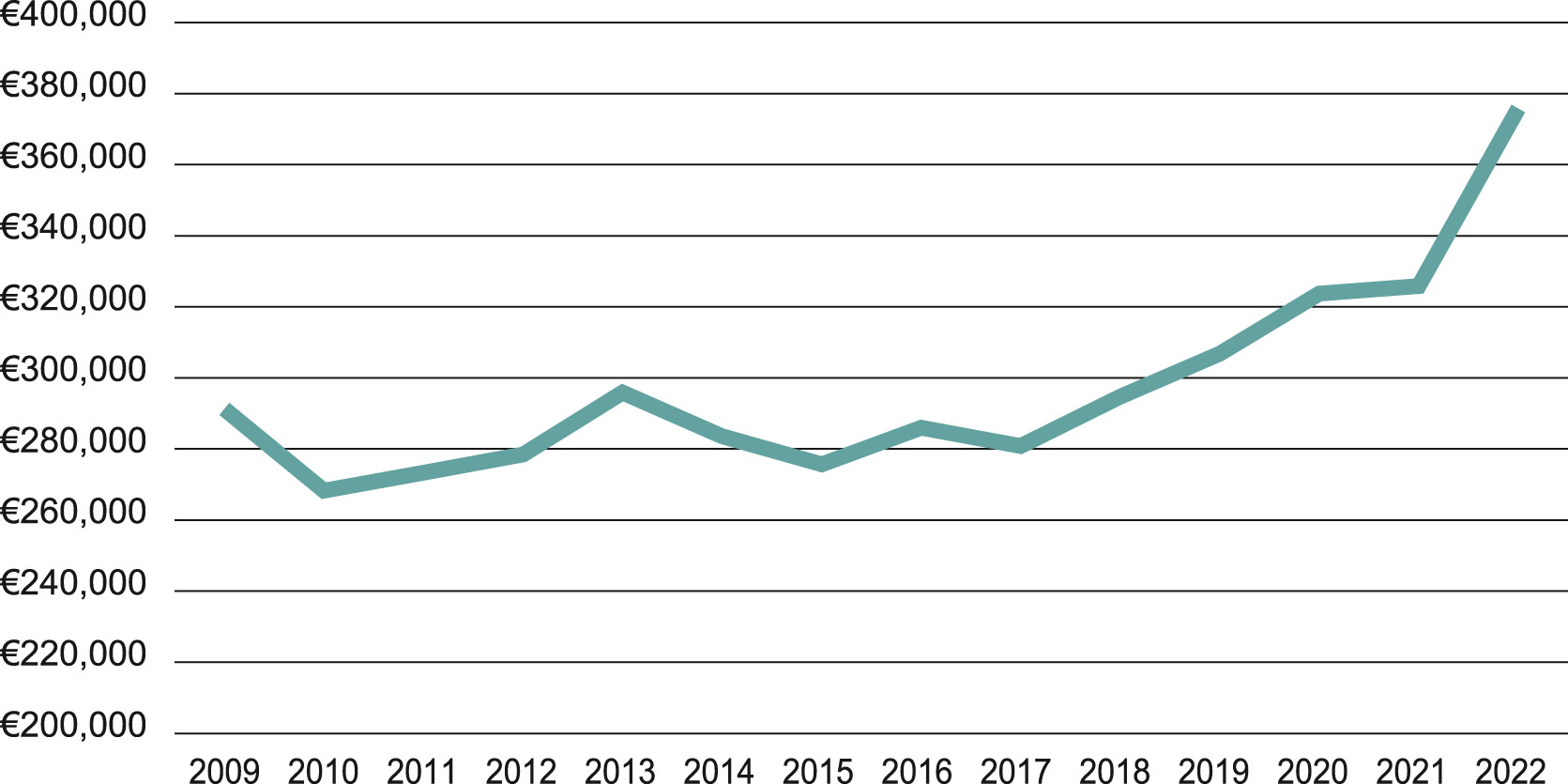

Expenditure on wages and salaries continued to rise, from €291,200 per pharmacy in 2009 to €375,783 in 2022, an increase of €84,583 or 29.05%. Rising employment costs continue to account for a greater proportion of a pharmacy’s revenue base. With many operators agreeing new pay rates in January 2023, employment costs will likely continue to rise in 2023 (the Fitzgerald Power survey only ran to 2022).

Figure 2: Average pharmacy wages and salaries costs — 2009 to 2022

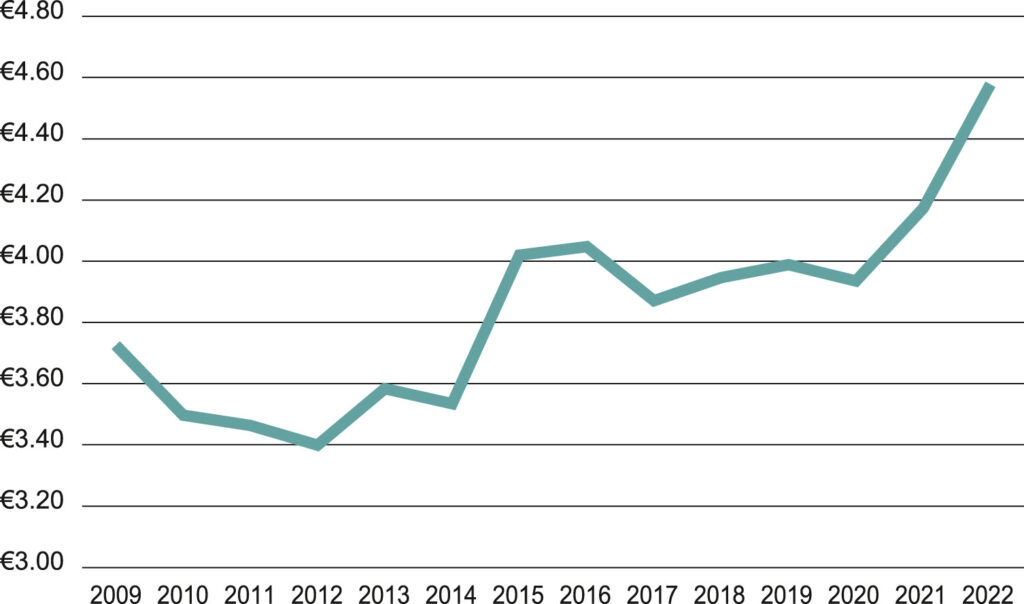

Increasing labour costs and declining revenue means the average labour cost of supplying one medicine item has increased significantly as shown in Figure 3. These calculations are based on total average pharmacist and technician salaries per pharmacy, divided by the average number of dispensed items per pharmacy in each year covered by the review.

Figure 3: Labour Cost per Medicine Item – 2009 to 2022

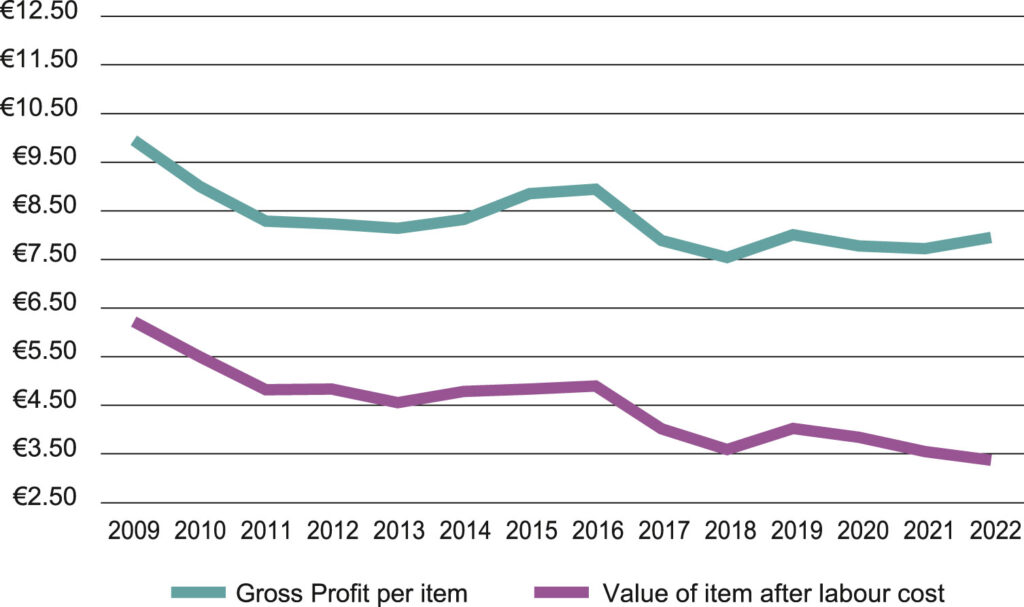

Although material labour and work practice efficiencies have been delivered across the sector during the review period, the cost of dispensing one item has increased from €3.73 in 2009 to €4.58 in 2022, an increase of 22.78%. As the average dispensing fee paid by the State has been reduced from €6.00 to €4.58, the average State fee only covers the cost of dispensing an item. The gross profit per item and gross profit after labour per item has reduced from €9.95 and €6.23 respectively in 2009 to €7.95 and €3.38 in 2022.

Figure 4: Profit per medicine Item — 2009 to 2022

Between 2009 and 2022 the volume of medicine items dispensed under State schemes increased by 26% (as the HSE has not published statistics for 2022, medicine volumes in the final year are estimated based on the compound annual growth rate between 2009 and 2021). During this period the administrative burden attached to State scheme dispensing increased dramatically. Pharmacists are working harder and their costs per item are increasing, while their profit per unit is declining. This is the principal reason for pharmacy closures, and why one in ten are currently operating at a loss.

But the impact is deeper than pharmacy closures. The sector is now less attractive to younger people than it once was. The owner-operator business model no longer provides a satisfactory level of return for the entrepreneurial risks and many long hours that are required to generate this dwindling return. This is a problem facing many industries, but the problem is even more acute in the pharmacy sector where entrepreneurs can’t set the prices paid by their largest customer.

It is also less attractive to well-educated pharmacist employees, who rightly figure they can earn more money in other sectors, or as a locum pharmacist.

If the State’s dispensing fee structure doesn’t cause pharmacy closures, a lack of available pharmacists will.

Based on our research, the Irish Pharmacy Union is calling for a flat State scheme dispensing fee of €6.50 per medicine item. For comparison, the average fee per item was €6.00 in 2009.

There is no request to change medicine reimbursement prices, even though the current inflationary cycle and the medicine shortage crisis suggests price inflation should be considered.

Under this proposal, the total annual dispensing fees paid to pharmacists would increase by approximately €162 million, or 41.92%. However, total payments to pharmacists including fees and medicine reimbursements would only increase by 11.44%, as reimbursement prices would remain unchanged.

It is worth noting that GPs received €186 million in COVID-19 payments from the State, and received significant reinvestment into the sector through the 2019 GP Agreement, while the 2023 budget for homecare has increased from €600 million to €700 million.

The proposed fee increase for pharmacists would return gross profit per State scheme item to 99.2% of the 2009 level, and profit after labour per item to 85% of the 2009 position.

It would help to stabilise the sector, protect community-based healthcare, allow pharmacists to introduce additional healthcare services and keep young people interested in a profession that has proven itself to be a vital part of the healthcare infrastructure during the COVID years.

The Annual Review of the Community Pharmacy Sector in Ireland 2022/23 is available to IPU members at ipu.ie > News and Publications > Annual Review of the Sector.

Stuart Fitzgerald,

CEO, Fitzgerald Power

Highlighted Articles