Home » 2025 IPU Pharmacy Index: What the public thinks about pharmacy

Every year, the IPU engages research and insight firm Ipsos B&A to carry out a comprehensive survey of the public to ascertain their attitudes towards pharmacists and pharmacies, and their usage of the services offered in pharmacies. In this article, Ipsos B&A Director Larry Ryan provides an overview of findings from the 2025 Report.

The 2025 IPU Pharmacy Index, based on research by Ipsos B&A, presents a compelling view of a sector which is adapting well to user needs, but which is perhaps still struggling to fulfil what customers hope and expect of it.

As in previous years, the research is based on a nationally representative sample of 2,000 adults aged 16 and over, using a hybrid approach, whereby 1,000 are interviewed face-to-face, in-home, and the balance are interviewed online. Face-to-face fieldwork was carried out from 28 March to 9 April and online fieldwork from 20 to 22 April.

It is important to note that the survey took place at a time of faltering consumer confidence. Many have been deeply unnerved by American threats about tariffs, particularly in early April, and concerned at the gradual up-creep of prices in supermarkets. Although there is general increasing optimism about the future, a substantial majority still indicate that they are no better off than before, with only one in six feeling they are doing better. Interestingly, younger adults are struggling a little more, whereas those who are older and in the family life stages, seem to be faring somewhat better.

Another sizeable contextual issue relates to the substantial number of those surveyed who are continuing to work from home. Obviously, this phenomenon has been in existence since the pandemic, but gradually there has been a transitioning into a more settled pattern, with many spending one to two days a week working from home, often bundling in their chores and shopping around their home time. This has inherently led to a shift in shopping patterns, with continuing indicators that people are shopping across a range of stores, often because they are now shopping in a relatively different location. The probable continuation of working from home will enshrine this trend, with presumably more shopping in suburban and outer suburban locations, and fewer making it to pharmacies in the principal town centres.

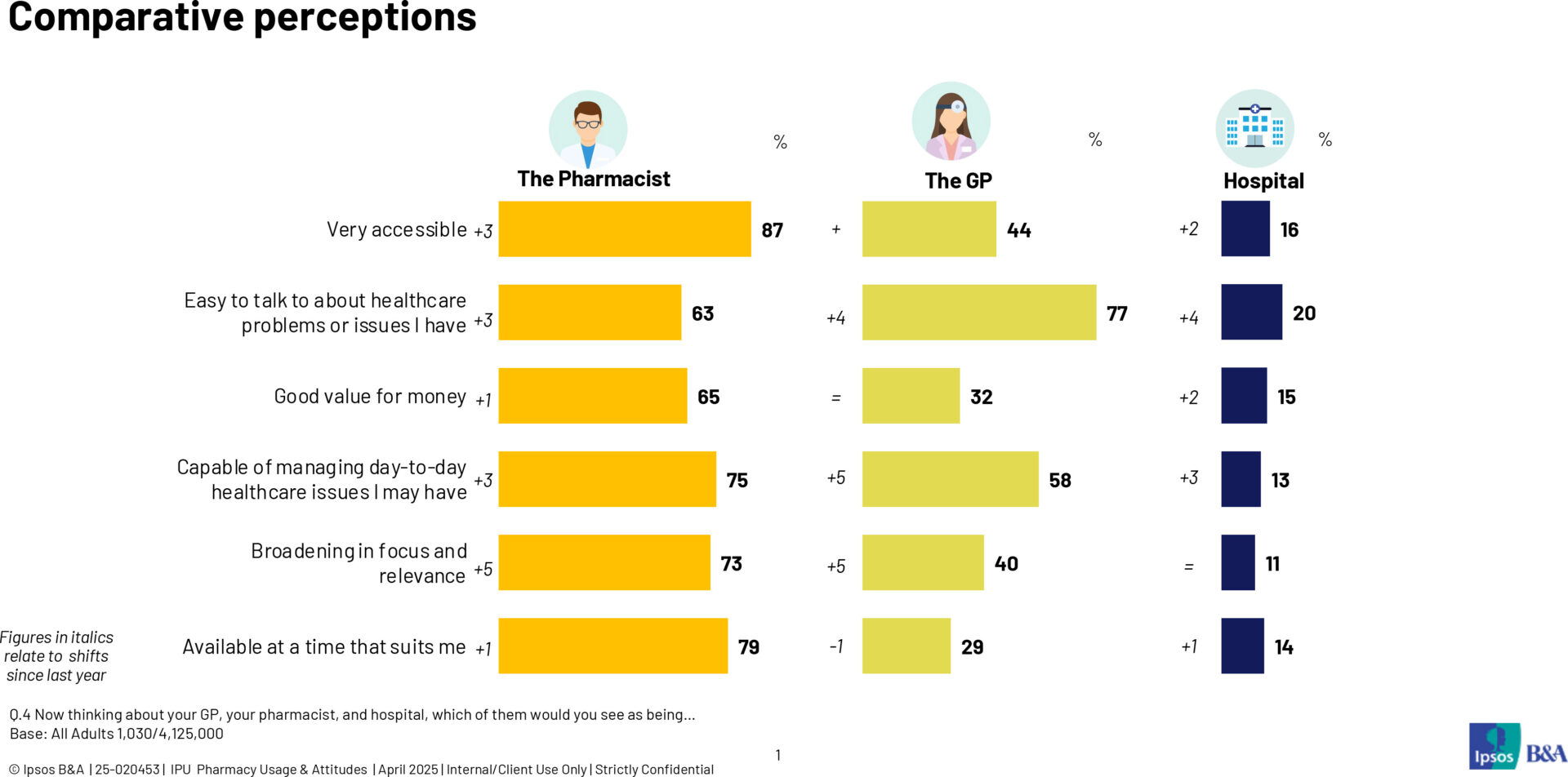

At the outset, one of the most striking facets of the 2025 survey is that pharmacy is performing very strongly in terms of public satisfaction. It is particularly noted as substantially broadening in focus and relevance and becoming more capable of managing customers’ day-to-day healthcare needs. Nonetheless, a key area in which it is struggling is in convincing customers that the pharmacist has sufficient bandwidth and is ‘easy to talk to about healthcare problems or issues that I have’.

Figure 1: Comparative perceptions

The pharmacy scores particularly high for accessibility and for availability at a time that suits the customer. Equally, visiting the pharmacy is regarded as relatively good value for money and particularly so in contrast with the cost of visiting the GP. The area where the pharmacy falls behind the GP is in convincing the customer that the pharmacist has the time and inclination to talk to them.

Broadly speaking, there is significantly increased footfall into pharmacy, with the numbers into pharmacy on a regular basis continuing to grow, as more regard it as an appropriate location for addressing their day-to-day medical issues and needs.

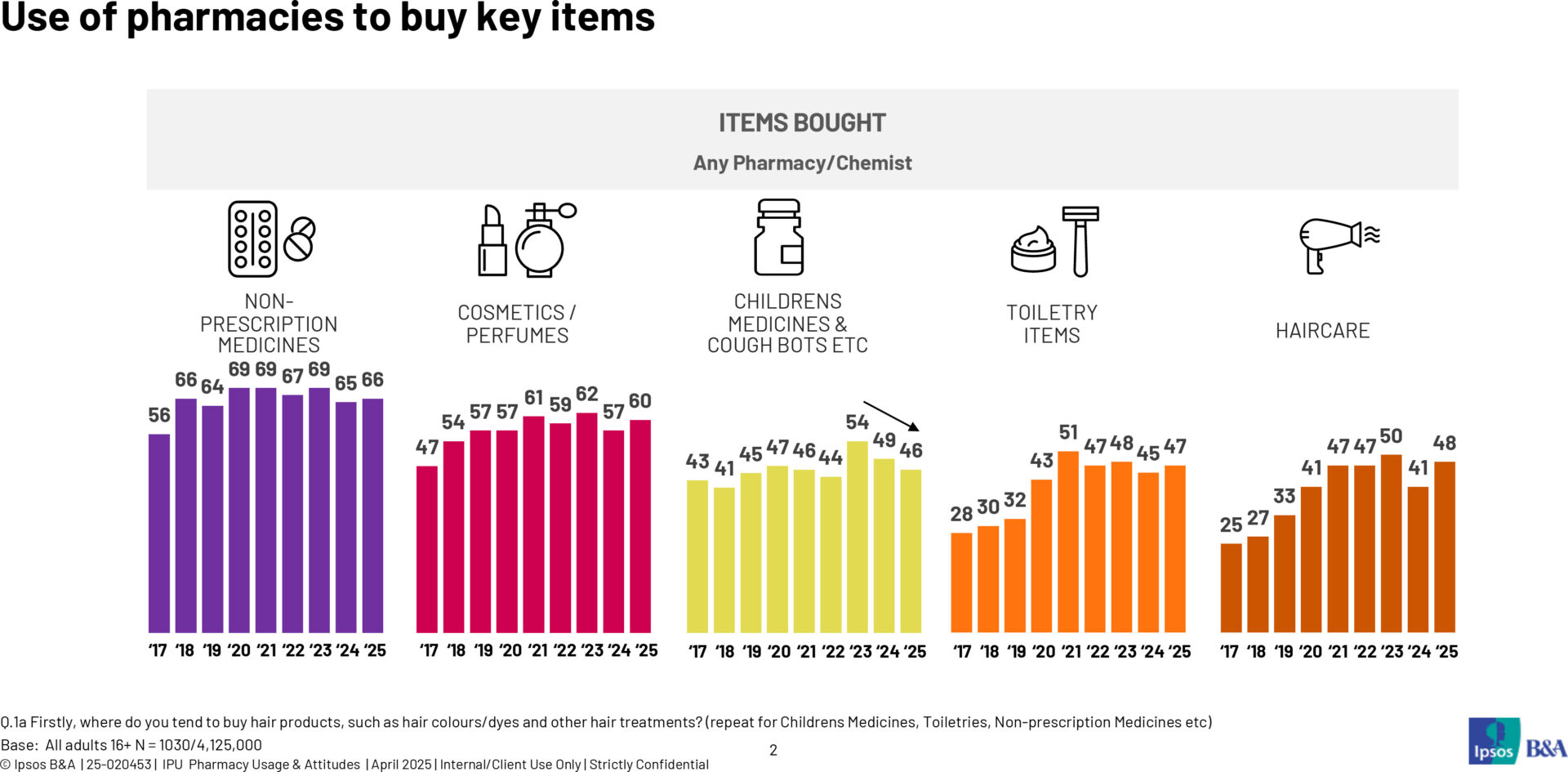

Although performing well, others are continuing to encroach into the pharmacies’ space. The pharmacy share of children’s medicines and cough bottles is coming under pressure, as supermarkets and others target the same territory. Supermarkets are particularly progressing in areas like haircare and non-prescription medications.

Figure 2: Use of pharmacies to buy key items

Over time, there is evidence that shoppers are using a broader range of store types, going to specific outlets for certain items where they can. Where pharmacy is facing competition like this, it is important that it sets out a more unique and proprietary stall to position it apart from purely price-based competition.

We also see that there continues to be widespread enthusiasm for the pharmacy broadening the range of services it provides, with most very supportive of such change and evolution. As such, pharmacists offering Common Conditions Services and triage-type services, is to be welcomed. However, there is some hint that customers can be a little concerned about too much of the pharmacists’ time being taken up with a range of schemes, such that they don’t then have time available to talk to the customer.

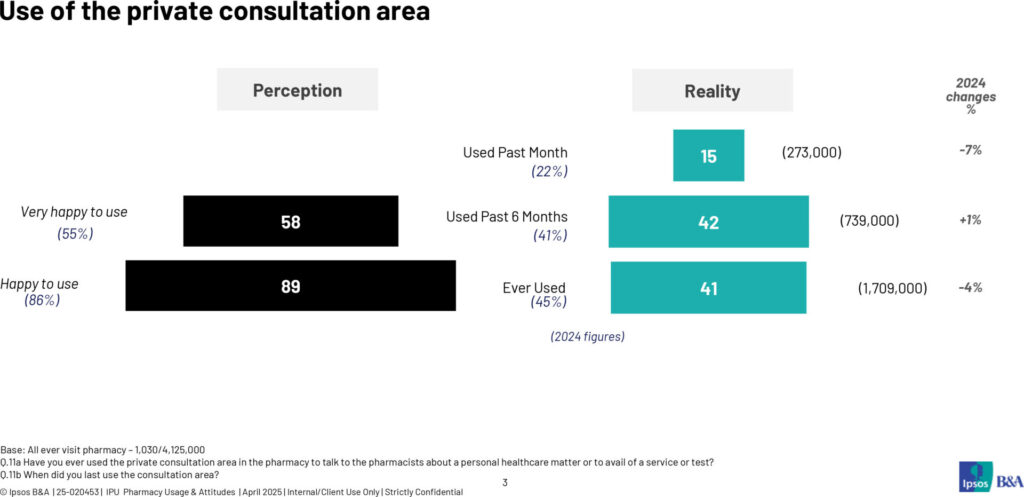

There is an evident need to focus on enhancing the level of service in-store. There is continuing enthusiasm to talk to the pharmacist in their private consultation area, but we also see that the numbers having done so in recent months has dropped considerably. There are two possible interpretations: one is that the pharmacist is too busy to deal with patients and while customers are keen to talk to them in the private consultation area, the pharmacist doesn’t really have the time for this; the alternative is that there may simply be a downturn in numbers availing of COVID vaccines, and that by comparison with last year, we simply have fewer needing to visit the consultation area to talk to the pharmacist.

Our suspicion however is that pharmacists may be struggling to dedicate sufficient time to see the number of customers wanting to talk to them, suggesting a constraint in the system relating to the growing number of weekly and monthly visitors, and potentially, ongoing workplace capacity issues.

Figure 3: Use of the private consultation area

Since the collapse in same-store loyalty that occurred at the time of the pandemic, we have seen a gradual recovery, with roughly half of all pharmacy customers saying they always use the same pharmacy and the balance varying the store that they use, often related to the need to shop in a number of different areas across the week. Those with much greater same-store loyalty tend to be older, more medically dependant and concentrated more in rural areas.

An interesting dynamic over the past seven to ten years has been the gradual shift from independent, owner-run outlets to the use of symbol group members, with younger customers somewhat more likely to have opted for symbol stores. The growth of symbols largely mirrors the decline of independents. It is probably fair to assume that those stores that are refitting and joining symbol groups are largely the ones targeting a younger shopper base, while those that remain as independents are more oriented to older, medically dependant customers.

Users of symbol pharmacies are as likely to interact with staff as those who use independents. However, customers of symbol members are considerably more likely to have spent time in the private consultation area than customers of independents. As such, we must assume that some symbols are better set up to handle casual queries and enquiries, whereas independents may be struggling in legacy store formats, which lend themselves much more poorly to facilitating greater levels of customer interaction.

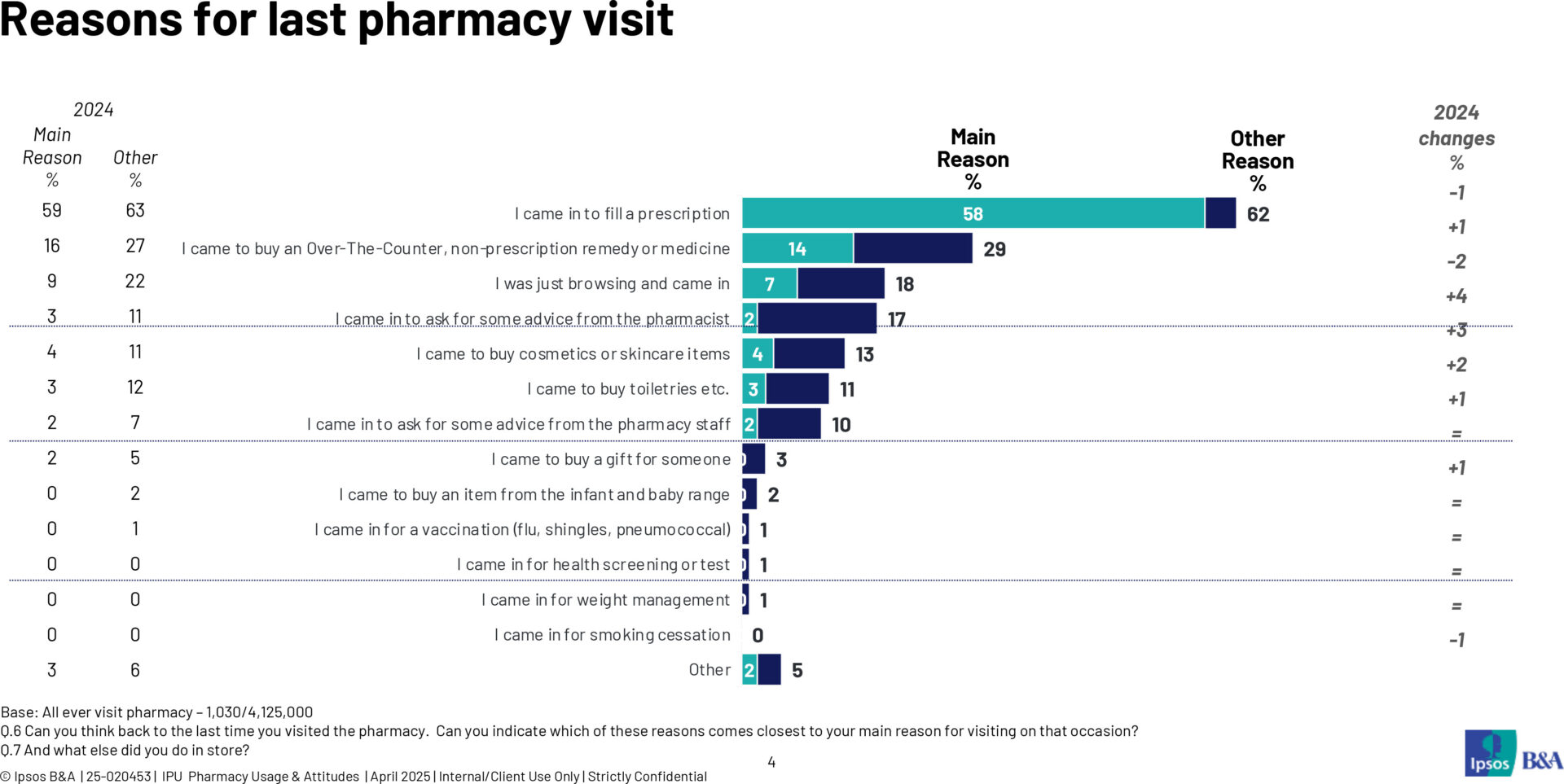

Growing importance of OTC and advice

Many pharmacy visits are driven by the need to fill prescriptions (almost 58 per cent indicate this is their main reason for the last visit), although we see that as many as three in ten also avail of the opportunity to make OTC purchases, with one in six looking for advice from the pharmacist and about 10 per cent coming in with a query for pharmacy staff. Evidently, interaction is important and, as such, nine in ten customers make a point of talking to staff in a typical visit. Indeed, certain treatment categories such as cold and flu, allergies, vitamins and probiotics all perform much better in stores where the pharmacist or their staff makes a recommendation to the customer.

Figure 4: Reasons for last pharmacy visit

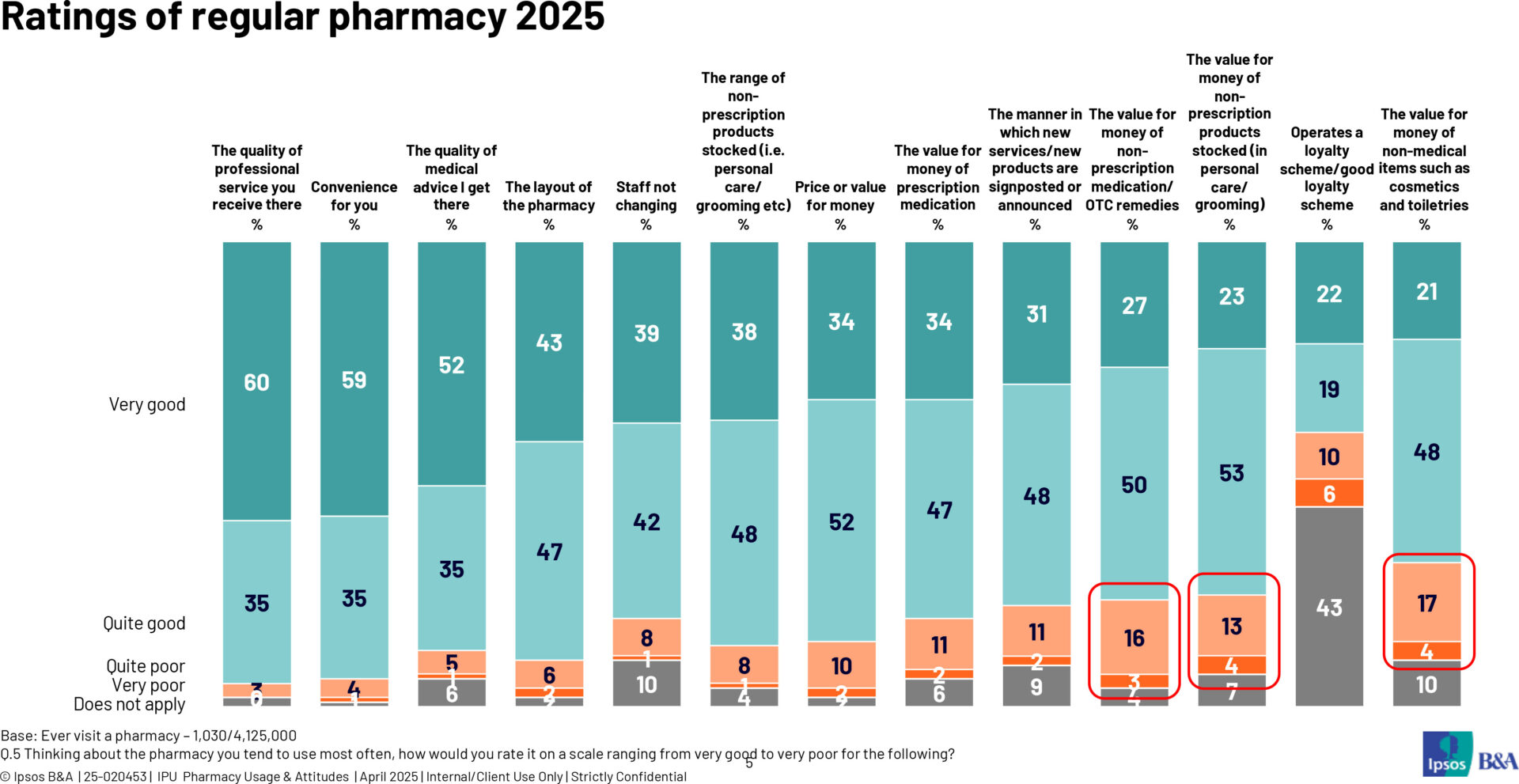

We are also noting a gradual easing in top-box or more enthusiastic scoring of some aspects of pharmacy service. In other words, there is a slight shift from ‘very good’ to ‘quite good’ assessments. However, it should be noted that we see similar trends across many sectors (and countries), at present. It is becoming much harder to please the customer in the current era; shoppers are somewhat more dispassionate and harder to please, so it beholds the pharmacy to make a particular effort to go above and beyond the normal or expected standard of service.

Figure 5: Ratings of regular pharmacy 2025

The research also illustrates that more than three out of four say they are having to wait much longer these days to get a GP appointment, with almost as many indicating that they will sometimes now rely on a pharmacist’s advice rather than opting to visit the GP.

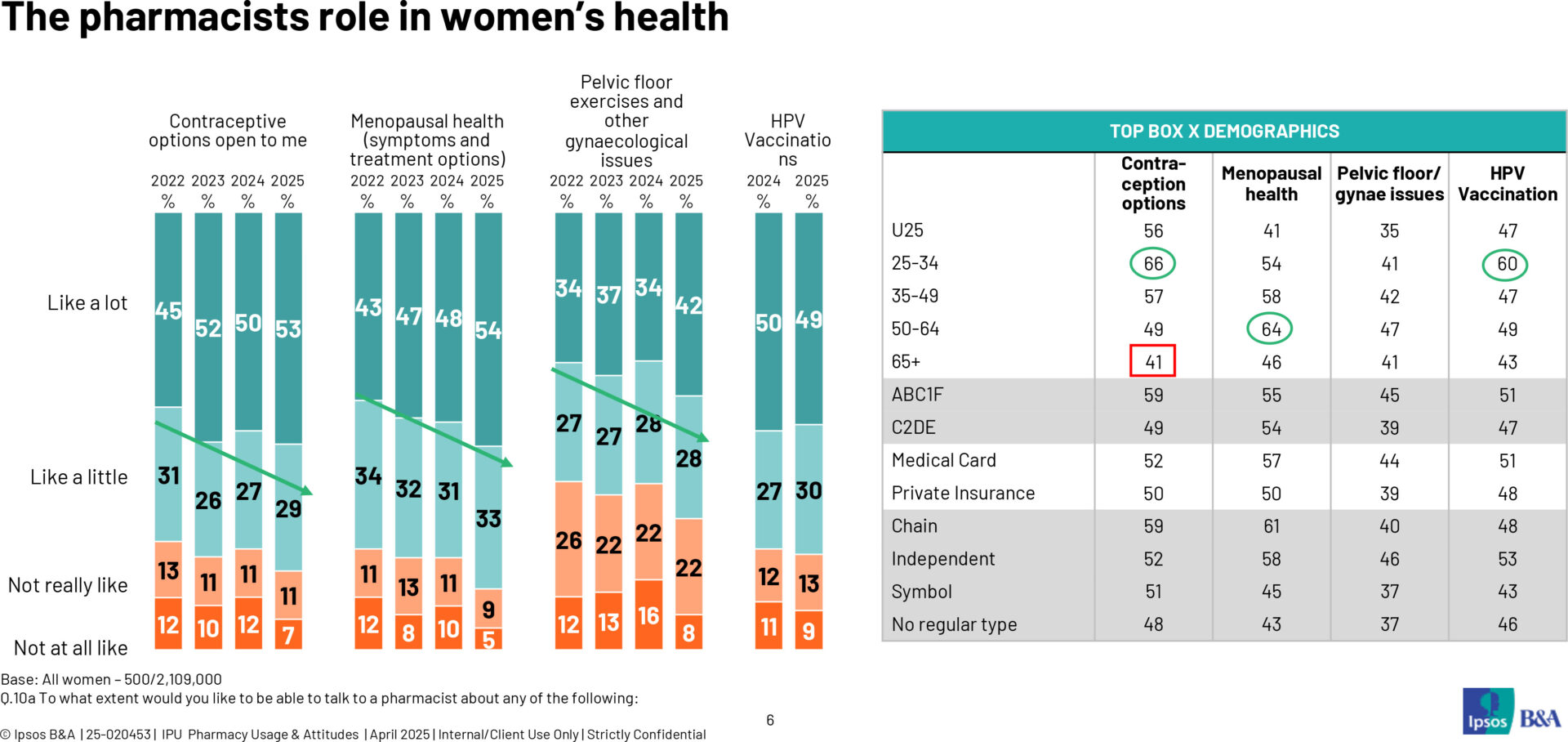

One very positive element emerging from the study is the continuing growth in interest in liaising with the pharmacist in areas such as menopause, contraception and gynaecological health. Interest in all of these areas continues to rise, suggesting that this is an aspect that pharmacy is handling well. There is some criticism that pricing within the pharmacy could be somewhat more transparent. The levels of such criticism are relatively modest, and it would be surprising if similar concerns weren’t flagged in the present, more straightened economic climate.

Figure 6: The pharmacist’s role in women’s health

Ultimately, the broad thrust of the feedback emerging in respect of pharmacy is very encouraging, although it is important that the pharmacist ensures that the customer perceives them as being easy to talk to (and available) to discuss healthcare problems or issues that they have. This is becoming more important in an era where most elements of the health system are overcrowded and struggling to keep up with demand. Pharmacy needs to communicate that it is ready, willing and available to talk to the customer.

The full report will be circulated to IPU members in early July.

Larry Ryan

Director, Ipsos B&A

Highlighted Articles