Home » Economic update for the pharmacy sector

Global background

Global economic and financial discourse continues to be dominated by the ongoing fight against inflation and the economic impact of tighter monetary policy. The monetary authorities in the US, UK and Euro Zone continue to tighten interest rates to bring inflation under control and not surprisingly, economic growth is under pressure. Central bankers are not unhappy about this, as there has been a realisation for some time that to bring inflation under control, economic growth would have to be curbed and unemployment forced higher.

On 14 September the ECB implemented its tenth successive interest rate increase, which has seen a cumulative increase of 4.5 per cent in rates since the end of July 2022. Following the latest rate increase the ECB president Christine Lagarde suggested that rates may now be at or very close to their peak, but that rates will remain at current historically high levels for a prolonged period. One cannot say definitively that rates will not rise further as that will really depend on how the economic and inflation data behave over the coming weeks. At this juncture another increase looks somewhat unlikely as the ECB would now be best advised to stand back and gauge the impact of the cumulative rate increases seen over the past year.

Headline inflation in the Euro Zone declined to 5.3 per cent in August, which is still well above the desired 2 per cent target, but it is down from a peak of 10.6 per cent in October of last year. The problem is that much of this decline has been driven by declines in oil and gas prices. Core inflation, which excludes energy, food, tobacco, and alcohol is still running at an unacceptably high 5.5 per cent. Of particular concern is the inflation rate of 5.5 per cent in the services sector. This is exactly the situation in Ireland, where service sector inflation is running at 9.5 per cent and goods inflation at just 2.5 per cent.

The overall picture is confusing and needs careful interpretation, but the bottom line is that indicators such as the labour market; consumer spending, the Exchequer finances and domestic business investment are all suggesting an ongoing reasonably strong level of economic activity.

Service sector inflation across the Euro Zone, and indeed in the US, is being largely driven by the tightness of labour markets. The unemployment rate in Ireland is close to a historic low of 4.1 per cent, and 6.4 per cent in the Euro Zone, which is the lowest since the euro was created in 1999. The ECB would like to see unemployment rise and would regard this as a price worth paying to bring inflation back under control.

Other indicators of activity in the Euro Zone suggest weakness, particularly in manufacturing activity, which is a particularly important sector in Germany. The Purchasing Managers Index (PMI) for manufacturing in the Euro Zone is at 43.5 and the PMI for services is at 47.9. These indices are constructed on the basis that a reading above 50 means that more firms are expanding rather than contracting, and a reading below 50 suggests more firms are contracting than expanding. Manufacturing is clearly in dire straits, while service sector activity is now trending weaker.

GDP growth in the Euro Zone declined by 0.1 per cent in the final quarter of 2022, and it increased by just 0.1 per cent in the first and second quarters of 2023.

These data are suggestive of an economy that is bouncing along the bottom, and inflation is gradually moving towards its target.

The German economy is a particular cause for concern, as it has weakened quite dramatically over the past year. GDP contracted by 0.2 per cent in the first and second quarters of 2023. The Purchasing Managers Index (PMI) for manufacturing was at 39.1 in August and the PMI for services was at 47.3. Germany is now being described as the ‘sick man of Europe’ and is struggling due to its heavy dependence on manufacturing and the associated energy dependence. The demographic profile is also a significant structural impediment to growth.

The other interesting global economic story now are the ongoing challenges in China. The Chinese economy continues to weaken, with subdued inflation, weak consumer spending, property sector problems, and weakness in external trade all strong features of the economic performance. Several large property development companies such as Country Garden and Evergrande are in serious financial trouble. These economic pressures are increasing political pressure on the authorities to inject more aggressive fiscal and monetary stimulus into the ailing economy. The Chinese economy and its financial system are under serious pressure and now pose an increasing threat to the health of the global economy.

The Irish economic performance has proven quite resilient despite the many global and domestic headwinds over the past couple of years.

GDP contracted by 0.9 per cent in the final quarter of 2022 and it contracted by 2.6 per cent in the first quarter of 2023. Consequently, this satisfies the technical definition of a recession. However, the reality is that GDP is a distorted measure of activity in the Irish economy due to the activities of the very important multi-national sector. It expanded by 0.5 per cent in the second quarter of 2023.

Modified Domestic Demand (MDD) is an important and more representative measure of underlying demand and excludes Intellectual Property (IPP) transactions and aircraft leasing-related globalisation effects. MDD is a broad measure of underlying domestic activity that covers personal, government, and domestic investment spending. It contracted by 0.2 per cent in the final quarter of 2022 and the first quarter of 2023 but expanded by 1 per cent in the second quarter of 2023. Within this, personal spending on goods and services, a key measure of domestic economic activity, increased by 1 per cent in the final quarter of 2022; was flat in the first quarter of 2023; and expanded by 0.9 per cent in the second quarter of 2023.

The reality is that output and exports from the chemical and pharma sector have weakened significantly this year, largely due to a post-COVID adjustment after very strong growth during the pandemic. This is being reflected in the weaker export performance so far this year. In the first 6 months, exports declined by 1.9 per cent, with the Medical and Pharmaceutical products component down by 11.5 per cent.

The overall picture is confusing and needs careful interpretation, but the bottom line is that indicators such as the labour market; consumer spending, the Exchequer finances and domestic business investment are all suggesting an ongoing reasonably strong level of economic activity.

In the second quarter of the year, employment reached a record high of 2,643 million, which is up by 3.5 per cent or 88,400 on a year ago. The employment rate for females stood at a record high of 70.5 per cent and the overall employment rate stood at a record high of 74.2 per cent. The unemployment rate is close to full employment at 4.1 per cent.

The annual rate of consumer price inflation peaked at 9.2 per cent in October 2022. It subsequent decelerated to 5.8 per cent in July 2023, but jumped by 0.7 per cent in August, to give an annual rate of 6.3 per cent. Higher global energy prices pushed petrol and diesel prices up during the month. The concern is that global energy and food prices could come under pressure over the coming months and inflation could prove difficult to bring down to acceptable levels.

The Irish economy continues to generally perform quite strongly, with the labour market, tax revenues and consumer spending all suggesting reasonable levels of economic activity. The export performance of the multi-national sector is undergoing an adjustment after a prolonged period of extreme buoyancy. This will take from the GDP performance in 2023. However, the real economy as measured by modified domestic demand (MDD) is likely to increase by around 3.5 per cent this year and 4.0 per cent in 2024.

There is still considerable uncertainty prevailing, with a slower global economy; rising interest rates; the elevated level of consumer prices all posing challenges.

The key positives for the economy include:

The key threats and challenges to the wellbeing of the economy include:

On balance, the Irish economy is in a reasonably good position and should be able to withstand the global headwinds. Budget 2024 on 10 October will give a stimulus to the economy, with the key focus likely to be on helping households deal with cost-of-living pressures; support for the SME sector; and measures to make the market more attractive for private landlords.

The consumer dynamics in the economy are reasonably strong. In the first seven months of the year the value of retail sales was 11 per cent higher than last year and the volume of sales increased by 6 per cent. Excluding the motor trade, the value of sales increased by 5.2 per cent and the volume of sales increased by 1.3 per cent. Inflation is boosting the value of sales, and when the motor trade is excluded, the volume growth in sales is more modest. During July, the value of overall retail sales declined by 0.3 per cent and the volume of sales declined by 0.8 per cent.

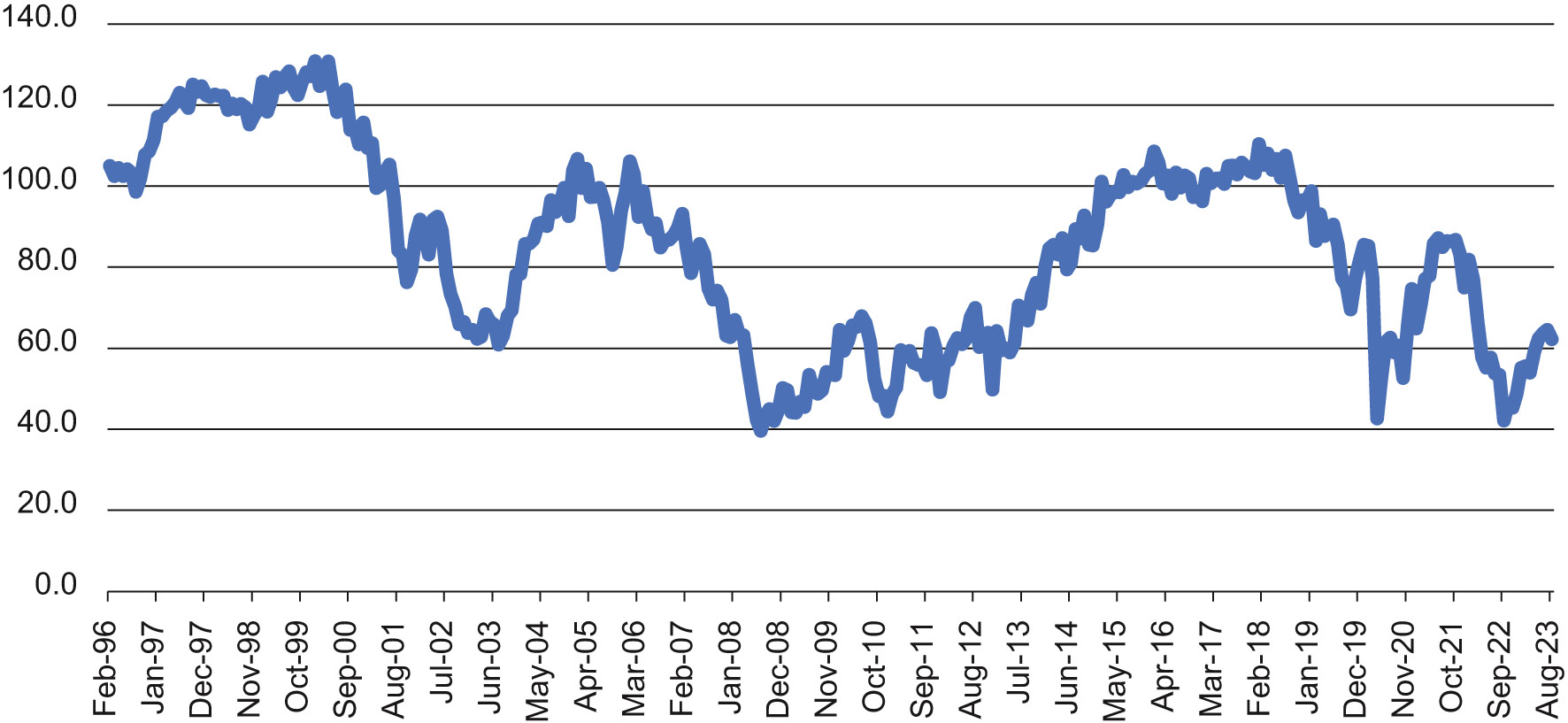

Consumer confidence has recovered over the past year but declined modestly in August. Rising interest rates and the ongoing cost-of-living pressures are having some impact on consumer sentiment and behaviour. Average mortgage interest costs in August were 51.3 per cent higher than a year earlier.

In the first seven months of the year, retail sale of pharmaceutical, medical, and cosmetic articles increased by 5.5 per cent in value terms and by 1.1 per cent in volume terms.

In the year to August, the average consumer price of pharmaceutical products increased by 3.5 per cent, with prescribed drug prices increasing by 2.2 per cent and Other Medicine up by 6.1 per cent. Inflation in the pharmacy sector is still lagging the rest of the economy.

Jim Power

Economist

Highlighted Articles